multi state auto insurance

Micromachines from multi state auto insurance

Image source: mdpi.com

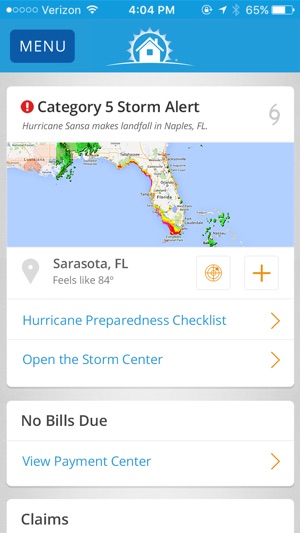

Security First Mobile on the App Store from multi state auto insurance

Image source: itunes.apple.com

Semi driver cited in eight vehicle crash from multi state auto insurance

Image source: journalstar.com

4gb Ram Octa Core 10 1 Android 8 0 Car Dvd Multimedia Player For from multi state auto insurance

Image source: dhgate.com

Toyota Fortuner 3 0D 4D 4x4 Ltd edition auto Specs in South Africa from multi state auto insurance

Image source: cars.co.za

Used TOYOTA ISIS 2005 for sale Stock tradecarview from multi state auto insurance

Image source: tradecarview.com

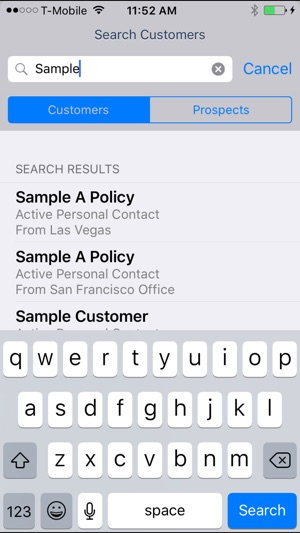

QQCatalyst on the App Store from multi state auto insurance

Image source: itunes.apple.com

Essential Methods When Choosing Car Insurance

Restricted versus Whole Tort

Auto insurance policies provide the plan holder the decision between restricted tort or full tort coverage. Limited tort means that you could sue for confined healing after an accident. Healing is limited in as you are able to however sue for medical expenses, but you cannot retrieve for pain and suffering. To the opposite, if full tort coverage is picked, recovery for suffering and enduring is possible, and often results in a bigger financial recovery.

Several people choose restricted tort coverage to help keep premiums low. Nevertheless, limited tort protection can cost you much more in the future by drastically limiting the quantity you can recover. Selecting complete tort insurance today can help you get the money you will need if you are later involved with a crash.

Minimum Coverage Limits

By law, auto insurance providers should offer bodily damage responsibility protection of at the least $15,000 per individual and $30,000 per occurrence, $5,000 to protect medical expenses, and $5,000 to protect property damage. Companies are not required to quickly offer other styles of insurance, such as revenue loss coverage for perform overlooked, or uninsured/underinsured motorist coverage (described below). These latter provisions are optional, and must be selected by the plan holder.

Much like limited tort coverage, several policy cases choose the minimal protection restricts to save lots of on premium payments. But, provided the climbing charge of medical treatment and different expenses (such as charge of living), the aforementioned minimums are consumed significantly prior to expected. Additionally, it's difficult to anticipate the consequences of an accident, such as for example just how much work is going to be overlooked, and how much property damage may occur. Generally where in actuality the minimum amounts are plumped for, that leaves the policy dish stuck with the bill. Choosing coverage restricts which surpass the minimum expected quantities, in addition to choosing elective types of protection now, can help you receive the amount of money you'll need if you should be later associated with a crash.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist insurance (UM/UIM coverage) can allow you to retrieve in a crash if one other driver isn't protected, or has hardly any insurance. If a collision happens, UM/UIM coverage applies to you, in addition to family members surviving in exactly the same household. It does not subject if you're the driver, an individual, or elsewhere associated with an accident, and UM/UIM protection can help purchase costs involving crashes whether the other driver is uninsured or underinsured.

When you have only the above minimum required limits and do not elect to have UM/UIM coverage on your own policy and are involved with a car crash, you will have to sue the other driver who is at-fault to recuperate anything above your policy limits.

In many cases where in fact the at-fault driver is uninsured or underinsured, that driver does not have ample assets, or any assets, to allow you to recover money. Ultimately, you can be caught with the bill. Selecting UM/UIM coverage today will help you receive the cash you'll need if you should be later associated with a crash.

You are able to change your auto insurance policy at any time. Call your insurance agent now – before it's also late. When you yourself have been or are involved with a car crash, contact an individual harm attorney when you can.

Luxury : Multi State Auto Insurance