countrywide auto insurance

No date announced for Mole Valley Farmers takeover of Taunton from countrywide auto insurance

Image source: somersetlive.co.uk

Steil Insurance from countrywide auto insurance

Image source: steilinsurance.org

The Best Auto Insurance of 2018 Reviews from countrywide auto insurance

Image source: reviews.com

Aviva Insurance Ltd Heritage Aviva plc from countrywide auto insurance

Image source: heritage.aviva.com

Beautiful 21 Countrywide Car Insurance Quote Wallpaper Site from countrywide auto insurance

Image source: doiton.us

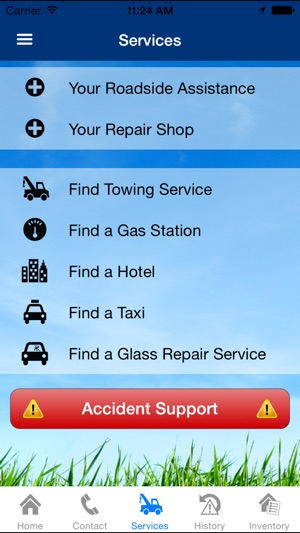

Country Wide Insurance pany Mobile on the App Store from countrywide auto insurance

Image source: itunes.apple.com

New DGIG water protection program available country wide from countrywide auto insurance

Image source: canadianunderwriter.ca

Important Recommendations When Choosing Car Insurance

Confined compared to Complete Tort

Auto insurance policies give the plan owner the choice between limited tort or whole tort coverage. Restricted tort means as possible sue for confined healing after an accident. Recovery is limited in as you are able to still sue for medical expenses, but you can't retrieve for suffering and suffering. To the contrary, if whole tort insurance is selected, healing for pain and putting up with is possible, and frequently leads to a more substantial economic recovery.

Many folks select limited tort coverage to help keep premiums low. However, limited tort coverage can cost you a lot more in the long run by drastically decreasing the amount you can recover. Selecting whole tort coverage today can help you obtain the amount of money you'll need if you're later involved with a crash.

Minimal Protection Limits

By law, auto insurance providers must provide physical injury responsibility protection of at the least $15,000 per person and $30,000 per incidence, $5,000 to protect medical costs, and $5,000 to protect home damage. Vendors aren't needed to immediately offer other kinds of insurance, such as for example revenue loss insurance for function missed, or uninsured/underinsured motorist coverage (described below). These latter provisions are recommended, and must be plumped for by the policy holder.

Just like limited tort protection, many plan holders select the minimum coverage restricts to save on premium payments. But, provided the growing charge of medical treatment and different expenses (such as cost of living), the above minimums are consumed significantly earlier than expected. Also, it is impossible to anticipate the results of a collision, such as for example how much perform is going to be missed, and simply how much house injury will occur. In most cases where in fact the minimum amounts are plumped for, that leaves the policy dish stuck with the bill. Choosing insurance restricts which exceed the minimum required quantities, as well as selecting optional types of insurance today, will help you receive the money you will need if you should be later involved in a crash.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist protection (UM/UIM coverage) can assist you to retrieve in an accident if another driver isn't insured, or has almost no insurance. If an accident does occur, UM/UIM coverage applies for you, along with members of the family living in the exact same household. It does not subject if you're the driver, a passenger, or elsewhere involved in an accident, and UM/UIM insurance can help purchase fees concerning crashes whether another driver is uninsured or underinsured.

If you have only the aforementioned minimum needed restricts and do not elect to possess UM/UIM insurance on your policy and are involved in a car crash, you would need to sue another driver who's at-fault to recover any such thing over your policy limits.

In many cases where in actuality the at-fault driver is uninsured or underinsured, that driver does not need adequate assets, or any resources, to allow you to retrieve money. Ultimately, you can be stuck with the bill. Choosing UM/UIM insurance today might help you obtain the amount of money you will need if you are later involved with a crash.

You are able to modify your auto insurance policy at any time. Call your insurance agent now – before it's also late. When you have been or are associated with a car crash, contact a personal injury lawyer as soon as you can.

Inspirational : Countrywide Auto Insurance