how to file an auto insurance claim against someone

Filing a Car Insurance Claim in the Philippines from how to file an auto insurance claim against someone

Image source: moneymax.ph

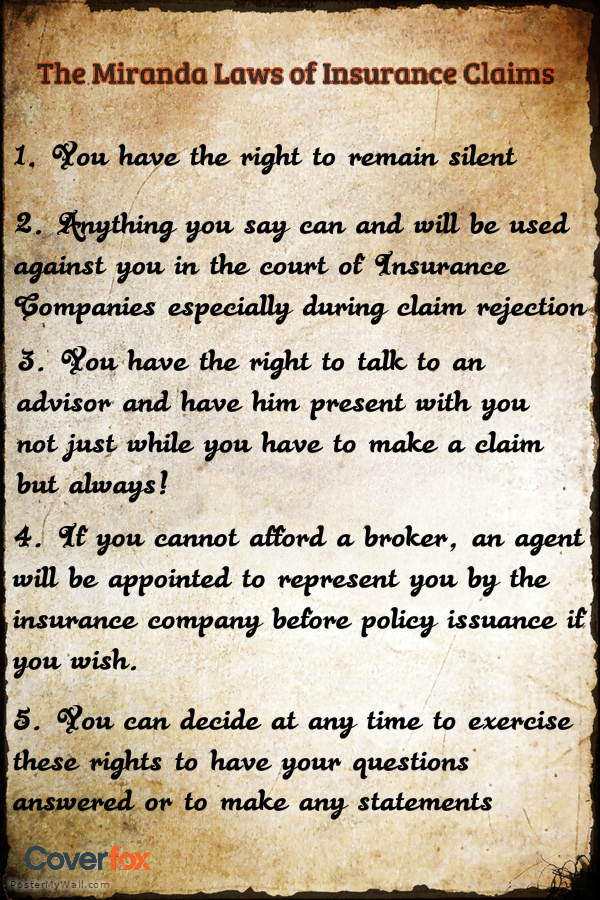

Car Insurance Claims Rejection & Denials from how to file an auto insurance claim against someone

Image source: coverfox.com

How to File an Earthquake Insurance Claim 15 Steps from how to file an auto insurance claim against someone

Image source: wikihow.com

Types of Car Insurance How does Car Insurance Work from how to file an auto insurance claim against someone

Image source: iselect.com.au

What is not covered by your motor insurance policy The Economic Times from how to file an auto insurance claim against someone

Image source: economictimes.indiatimes.com

Oriental Car Insurance line with Reviews from how to file an auto insurance claim against someone

Image source: bankbazaar.com

Philippine Insurers and Reinsurers Association PIRA Motor from how to file an auto insurance claim against someone

Image source: pirainc.org

Essential Methods When Choosing Car Insurance

Restricted compared to Full Tort

Auto insurance policies supply the policy dish the option between confined tort or whole tort coverage. Confined tort suggests as possible sue for restricted healing following an accident. Healing is restricted in that you can however sue for medical costs, but you can't retrieve for suffering and suffering. To the opposite, if complete tort coverage is picked, recovery for pain and enduring is achievable, and often results in a more substantial economic recovery.

Several individuals select limited tort protection to help keep premiums low. But, limited tort insurance may cost you a lot more in the long run by dramatically limiting the quantity you are able to recover. Selecting full tort coverage now will help you obtain the money you will need if you should be later involved in a crash.

Minimal Protection Limits

By legislation, auto insurance providers must offer physical harm liability protection of at the least $15,000 per individual and $30,000 per occurrence, $5,000 to protect medical costs, and $5,000 to cover property damage. Vendors are not necessary to instantly give other forms of insurance, such as money loss insurance for function overlooked, or uninsured/underinsured motorist insurance (described below). These latter provisions are elective, and should be selected by the policy holder.

Just like restricted tort insurance, many policy cases choose the minimal coverage limits to save on premium payments. However, provided the increasing price of medical therapy and other expenses (such as charge of living), the above minimums are utilized much earlier than expected. Moreover, it's difficult to estimate the results of a collision, such as for example how much perform is likely to be missed, and how much home injury will occur. Generally where in actuality the minimum quantities are chosen, this leaves the plan owner caught with the bill. Selecting insurance restricts which surpass the minimal needed quantities, as well as choosing elective forms of insurance now, might help you obtain the cash you need if you are later involved in a crash.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist protection (UM/UIM coverage) may allow you to retrieve in a crash if the other driver is not insured, or has very little insurance. If a crash occurs, UM/UIM coverage applies to you, as well as family unit members residing in the exact same household. It does not matter if you're the driver, a passenger, or else involved in an accident, and UM/UIM protection can help buy fees involving failures whether the other driver is uninsured or underinsured.

When you yourself have just the above minimal required restricts and do not elect to have UM/UIM protection in your plan and are involved in a car crash, you will have to sue one other driver who's at-fault to recoup such a thing over your policy limits.

Oftentimes where in actuality the at-fault driver is uninsured or underinsured, that driver does not have ample resources, or any resources, to enable you to recover money. In the long run, you could be caught with the bill. Selecting UM/UIM insurance now might help you receive the cash you will need if you should be later involved with a crash.

You can change your auto insurance policy at any time. Contact your insurance agent today – before it's also late. If you have been or are involved with a car crash, contact a personal harm attorney as soon as you can.

Luxury : How to File An Auto Insurance Claim Against someone