government auto insurance programs

119 best Auto Insurance & Driving Tips images on Pinterest from government auto insurance programs

Image source: pinterest.com

How to Be e an Auto Insurance Agent with wikiHow from government auto insurance programs

Image source: wikihow.com

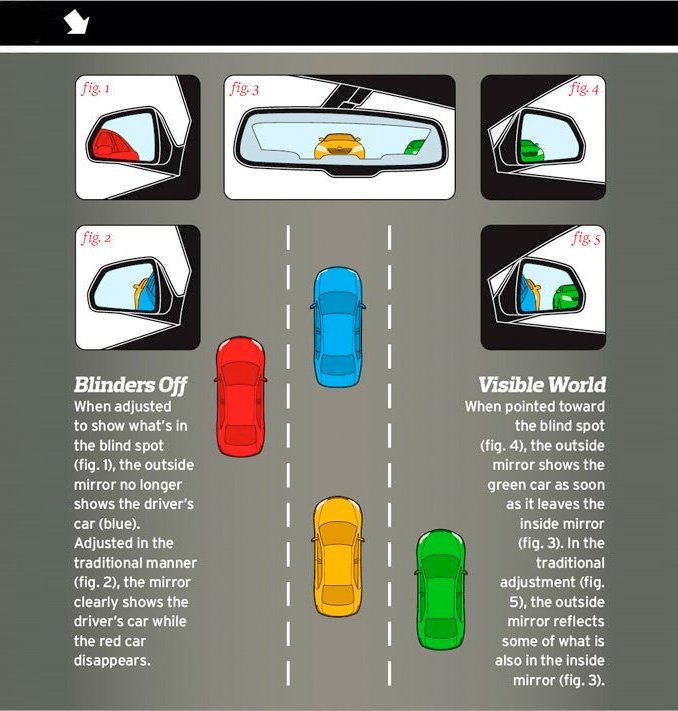

119 best Auto Insurance & Driving Tips images on Pinterest from government auto insurance programs

Image source: pinterest.com

Insurance panies Accounting and Statutory Requirements ICICI Lom… from government auto insurance programs

Image source: slideshare.net

Buying a New Car in tario from government auto insurance programs

Image source: humberviewgroup.com

Filing a Car Insurance Claim in the Philippines from government auto insurance programs

Image source: moneymax.ph

253 best Insurance Infographics images on Pinterest from government auto insurance programs

Image source: pinterest.com

Crucial Recommendations When Choosing Car Insurance

Confined vs Complete Tort

Auto insurance policies provide the plan case the choice between confined tort or full tort coverage. Confined tort indicates as you are able to sue for restricted recovery after an accident. Recovery is limited in that you could however sue for medical costs, but you cannot recover for suffering and suffering. To the contrary, if whole tort insurance is selected, recovery for suffering and suffering is achievable, and often leads to a bigger financial recovery.

Many people select restricted tort coverage to help keep premiums low. But, restricted tort coverage can cost you far more in the long term by considerably restraining the quantity you can recover. Selecting complete tort coverage now will help you get the money you will need if you are later involved in a crash.

Minimum Coverage Limits

By law, auto insurance providers should present bodily harm responsibility protection of at the least $15,000 per individual and $30,000 per incidence, $5,000 to cover medical expenses, and $5,000 to protect property damage. Providers are not necessary to immediately give other forms of coverage, such as for example money reduction coverage for work missed, or uninsured/underinsured motorist insurance (described below). These latter provisions are recommended, and must be chosen by the policy holder.

As with confined tort coverage, several plan members choose the minimum protection limits to truly save on premium payments. However, provided the climbing charge of medical therapy and other costs (such as cost of living), the above minimums are consumed significantly sooner than expected. Also, it's difficult to anticipate the consequences of a collision, such as for example just how much perform is going to be missed, and how much house damage can occur. Typically where in actuality the minimal amounts are picked, this leaves the policy dish stuck with the bill. Picking coverage restricts which exceed the minimum required amounts, along with choosing elective kinds of protection now, might help you receive the cash you'll need if you are later associated with a crash.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection (UM/UIM coverage) can allow you to retrieve in an accident if the other driver isn't protected, or has very little insurance. If an accident happens, UM/UIM coverage applies for your requirements, in addition to family unit members surviving in the exact same household. It doesn't matter if you are the driver, an individual, or else involved in a collision, and UM/UIM insurance will help buy costs concerning failures whether another driver is uninsured or underinsured.

When you have only the above mentioned minimum expected limits and don't opt to possess UM/UIM protection on your own plan and are involved with a car crash, you would need to sue another driver who is at-fault to recoup anything over your plan limits.

Oftentimes where the at-fault driver is uninsured or underinsured, that driver does not have ample assets, or any assets, to allow you to recover money. In the end, you might be stuck with the bill. Selecting UM/UIM insurance now can help you obtain the amount of money you'll need if you're later involved with a crash.

You can change your auto insurance policy at any time. Call your insurance agent today – before it's also late. If you have been or are associated with a car crash, contact a personal injury attorney as soon as you can.

Lovely : Government Auto Insurance Programs