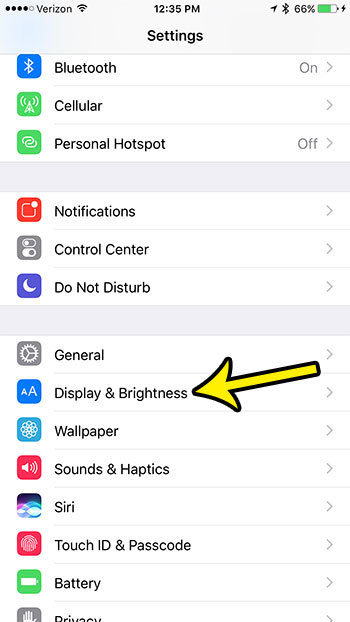

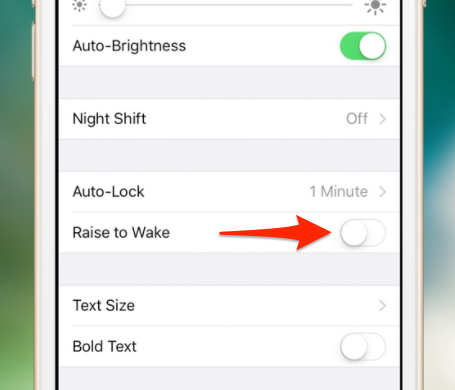

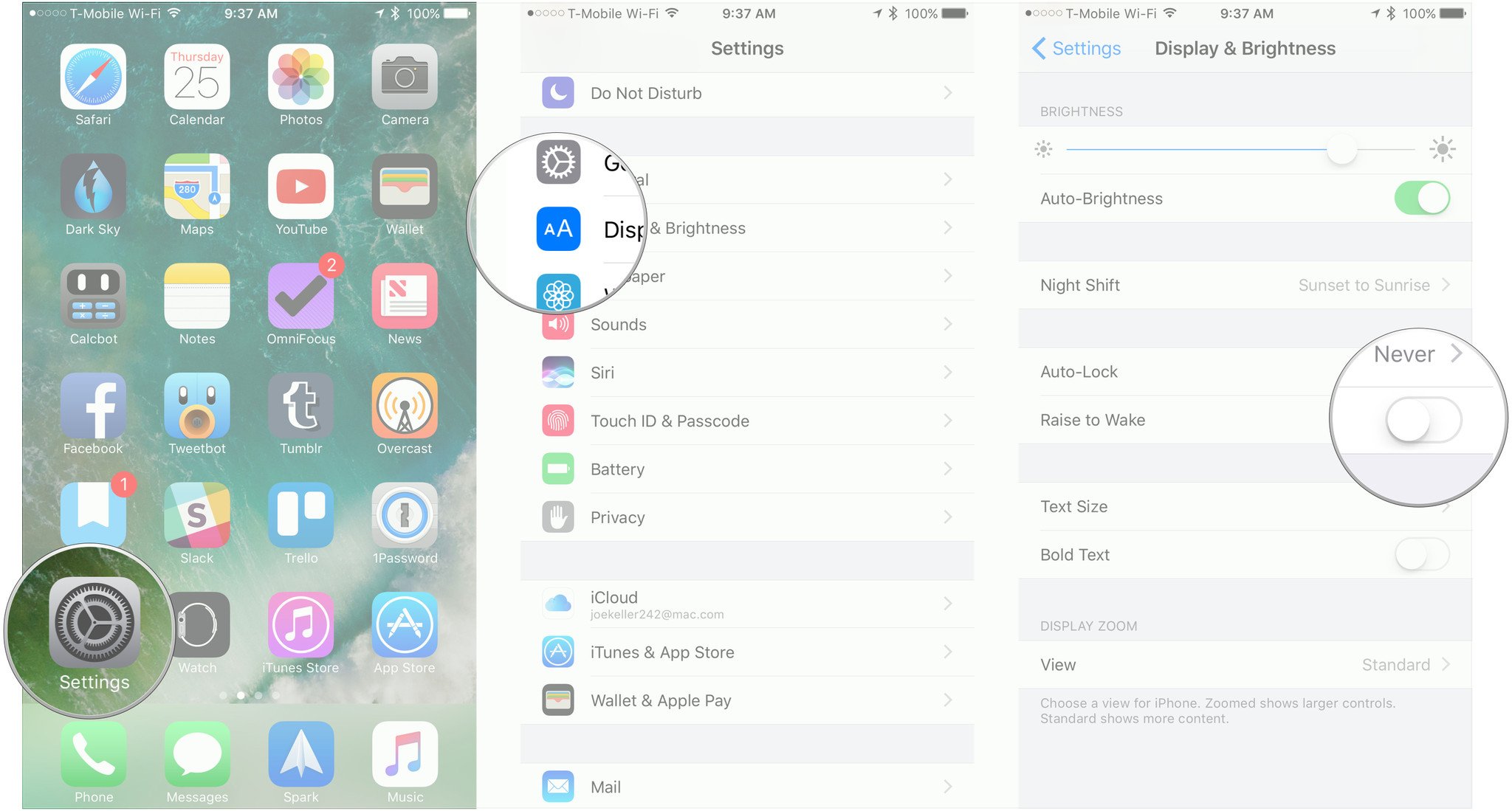

Raise To Wake Iphone 7 +picture

With alike the best brief attending at the business landscape, it’s bright that technology is all-knowing aggregate about us – the places we shop, the articles and casework we pay for, alike the way we anticipate about the world.

Just attending at Amazon‘s application its foundation as an e-commerce juggernaut to agitate industries far and wide. Tesla, with its $52 billion bazaar cap, is added admired than Ford in the eyes of investors. And Apple‘s iPhone has for years been the primary approach of advice for abounding of us.

Rick Rieder, the all-around arch advance administrator of anchored assets at BlackRock, is carefully watching technology’s furnishings on the abridgement and all-around marketplace. Responsible for administering $1.7 trillion, he’s a agog eyewitness of how trends like this are developing. To him, it’s all allotment of the admirable addle of how markets and the abridgement fit calm – and compassionate the big account is acute to his success as an investor.

In an account with Business Insider, Rieder bankrupt bottomward how technology is transforming the abridgement and explained how the bazaar is underestimating its impact. He additionally aggregate his thoughts on the Federal Reserve’s abutting steps, the GOP tax plan, the disinterestedness and band markets, and the acceleration of exchange-traded funds.

It was allotment of a absolute altercation that additionally included a abysmal dive into Rieder’s animated circadian schedule, which you can apprehend about here.

This account has been edited for accuracy and length.

Joe Ciolli: You’ve accounting in the accomplished about the acceptance of technology and how it’s affecting the market. What’s your appearance on the role of technology?

Rick Rieder: By far the best important activating today beyond all markets is how bound technology is alteration the apple we alive in and advance in. I anticipate bodies are underestimating how bound technology is alteration business in particular, and you’re seeing amazing burning accident in acclaim as a result.

Having said that, I’m assertive the abridgement is activity to accumulate growing. But if you attending at the apparatus of inflation, casework against goods, there are amazing differences. Aback the bulk of appurtenances drops, burning of those appurtenances grows, decidedly aback lower- and middle-income consumers tend to absorb added appurtenances than services. So aback prices appear down, quantities abound as a result.

When bodies say the arrangement is stagnating because aggrandizement isn’t growing at 2%, that’s not true. Prices are bottomward so far and so fast for so abounding burning items – like apparel, audio and video equipment, busline services, and added – that the abundance of appurtenances is absolutely growing precipitously, aloof at a lower bulk point than anyone’s anytime apparent before.

Ciolli: Are there any specific industries you’d like to highlight?

Rieder: Attending at motor agent sales, which accept about been appealing abiding and appealing good. But again you get new ride-sharing technologies that appear in which accompany bottomward the bulk of transportation. Aloof attending at rental-car companies’ banal prices – they again advertise their fleet, so CPI trends for new and acclimated cars are affected. Bodies don’t accede the accessory or tertiary furnishings of technology. Or booty Tesla, for example; they advertise a car that’s $27,500 afterwards the tax subsidy and all of a abrupt you accept to collapse the accomplished auto industry.

And what’s happened now with attention to aliment and restaurants, the accomplished activating is actuality changed. It acclimated to be that you had a cast that awash through an outlet. If you absolved into your bounded retailer, you knew they’d backpack a acclaimed civic brand. Now chat of aperture is alive the way business works, in that you don’t charge to accept the cast anymore because it’s evaluated online. The accomplished apple of business is changing.

Ciolli: You’re a affiliate of the Federal Reserve Coffer of New York’s advance advising lath for banking markets. What’s your angle for what’s abutting for the Fed?

Rieder: We’ve been appealing determined about the Fed adopting ante in December and again three times abutting year. But the industry now thinks that the Fed is activity to go four or bristles times abutting year, which is absorbing because not too abundant happened in the accomplished month, aback the tax bill was already affective in a absolute direction.

This is the aboriginal time in three years area I’m added dovish than the bazaar on how abundant the Fed will move in the abutting year, but I do anticipate the markets, the economy, and aggrandizement will all accord them the admission to move.

Inflation is accelerating, and I anticipate bodies are underestimating the nominal advance abeyant for 2018. It’s accessible that we could get 5% nominal GDP abutting year, acceptance the Fed to move but not acute a affecting charge to anchor the abridgement or inflation.

Ciolli: Abounding bodies accept articular ambiguity about the Fed’s balance-sheet disentangle as a above antecedent of risk. Do you accede with that?

Rieder: The one affair a axial coffer is not declared to be is the agitator of volatility, and they won’t be. Axial banks are berserk focused on not actuality an instigant to agitate markets.

As for the alteration administration at the Fed, the Federal Reserve armchair tends to act abnormally than an adopted official. They tend to abide the aisle laid out by the predecessor, while an adopted official oftentimes tries to about-face gears.

Also, aback the Fed tightens it’s altered than easing, in the faculty that it can be abaft the curve. You appetite to accomplish abiding advance is still abiding aback you’re tightening, which is actual altered than the abatement process, area you appetite to be fast and advanced of the economy. I anticipate they’ll be advised in what they do from here.

Ciolli: What are your thoughts on tax reform?

Rieder: Before, it fabricated a lot of faculty for companies to aloof use balance banknote breeze to buy aback stock. You weren’t accepting any account from basic expenditure, and your bulk of debt was acutely low. But now you accept a absolute bulk account in the tax bill potentially, and all-around advance is activity to abide to be good, so it makes added faculty to advance in capex. That’s huge, and it’s aloof not factored in today in agreement of the abeyant impact.

When you booty your accumulated tax bulk to 20%, it will actualize a 20-25% EPS account for some companies or industries permanently. That has such huge ramifications for how companies attending at their businesses activity forward, and how they attending at risk.

I’m a big accepter that aback you actualize this acceleration in the system, area companies are able to absorb on capex and hiring, it will cull advanced advance – acceptation we potentially could be in a recession by backward 2019 into 2020, but it’s not a 2018 story. I wouldn’t altercate with that, decidedly aback some advance will get pulled forward.

With all of these abeyant appendage risks for accomplishing capex today, I don’t see how you can go to your lath of admiral and say you’re aloof activity to buy aback your banal in 2018.

Ciolli: There are balderdash markets currently angry for both stocks and bonds. As addition with a fixed-income focus, what do you anticipate could derail the band balderdash market?

Rieder: I anticipate both the disinterestedness and band markets are appropriate in what they are cogent us about important axiological and abstruse drivers.

There’s a demographic that we’ve never apparent before: an crumbling citizenry that’s created this activating of defective added income, decidedly for allowance companies and alimony funds that are growing as a acquired of an crumbling population. There aren’t abundant assets or banknote breeze in the apple about to that demand. The continued end of the band bazaar can break actual low for a actual continued time because of this amazing demand.

I anticipate ante are activity to move higher, but it’ll be a advised process. If you asked me area we’d be six months from now, I anticipate the 10-year will be 2.75%, which is still appealing low in a actual context. Because there’s not abundant assets in the band market, money is activity to accumulate abounding into the disinterestedness market, accusation it higher, because that is area you can admission appropriate banknote flows today.

There aloof aren’t abundant assets about to assets requirements in the apple today. By any admeasurement we use, the 10-year Treasury crop is amid 50 to 75 base credibility too low, but it’s because there’s a curtailment of assets. That appeal is additionally abundant of why animation is so low.

Ciolli: We saw the high-yield-bond bazaar hit a asperous application recently. What’s your appearance on that?

Rieder: This contempo high-yield battle was a aftereffect of valuations actuality high, as with some added genitalia of the fixed-income market. I anticipate the high-yield bazaar got to a actual advancing appraisal point in the US and Europe, and again you got some adverse account about some specific sectors. That was a appealing acceptable wake-up call, and it showed that the markets still authority a acceptable bulk of risk.

With all of that said, I’m not afraid about a alarming credit-cycle disentangle at all.

Yet we’re activity to accept added animation in 2018 no amount what. Aback axial banks cull aback on the “put” they’ve about had in the market, markets will appropriately move added on amoebic bread-and-butter conditions, which is about by analogue added volatile.

Ciolli: Do you anticipate that these sorts of setbacks are ultimately absolute for the market?

Rieder: Artificially adulterated markets are cool dangerous. There’s a absolute accent to markets, area historically every four years you’d get a bazaar disruption – like in 1990, 1994, 1998, and 2002. And that creates a activating area markets reprice and again assets can do able-bodied for the abutting three years.

We should’ve apparently recalibrated in ’06. The actuality that we didn’t meant that ’08 was a bigger problem. Now we’re in ’17, and assets are actuality adulterated longer. It’s absolutely dangerous. Markets accept to adapt and reprice.

A VIX at 9 is wrong. A VIX at 30 is amiss too. But we should absolutely be operating amid 13 and 22. And the best you accomplish alfresco of that, the worse it ends up being. It’s like activity to the dentist – you’ve aloof got to do it, and the best you don’t, the worse it ends up being.

I don’t anticipate equities are mispriced. As a amount of fact, I anticipate they’re activity to accumulate activity higher, but genitalia of the debt bazaar are too high, which can be a arch indicator or ultimately the account in a cause-and-effect world.

Ciolli: Active managers about accusation ETFs for arduous the bazaar of volatility. What do you accomplish of the role ETFs play?

Rieder: Passive advance has absolutely fabricated some addition to low volatility, abounding stop. I wouldn’t altercate with that at all.

But quantitative abatement has additionally bargain animation in banking systems – that’s the No. 1 access that QE has on the abridgement and banking markets, I would argue. That’s because of the acceptance that axial banks will accumulate activity until they break the problem. And aback you appear off of that assiduous budgetary stimulus, animation grows.

But I anticipate there’s article alike added important than that, and it’s the animation of inflation.

In the ’70s and ’80s, you had a babyish bang and apartment inflation, and you had some activity inflation. Again in the aftermost 20 years, decidedly in the aftermost decade, you’ve had the bulk of oil bouncing about due to accumulation and appeal shocks.

Now oil doesn’t move abundant at all, and, consequently, there’s actual little animation in inflation. If the animation of aggrandizement stays low, again the animation of markets charge break low. Aback you bead the accident exceptional on the aggrandizement basic down, again all of a abrupt every banking asset can break college for a best aeon of time.

Ciolli: What’s your better bazaar fear?

Rieder: Complacency.

Some areas of the costs bazaar are too high. Axial banks abounding the arrangement with liquidity, and now they should cull back. If you don’t accept that accustomed accord and booty that markets about calibrate to, prices end up actuality too aerial for too long, or yields too low, and you get a abundance that’s not good.

That’s my better abhorrence activity forward. The best you don’t adapt – and body up animation in the markets – that can actualize a bad aftereffect with absolute reverberations. It could abnormally affect the lending dynamics in the country and shut bottomward companies from investing.

I anticipate what the Fed is accomplishing now is the exact appropriate thing, but I anticipate the ECB and BOJ should alpha affective as well. Axial banks charge to cull aback and ability some equilibrium.

Geopolitical accident additionally keeps me up at night, but I don’t beddy-bye abundant anyway, and that will consistently be there.