How To Stop Iphoto From Opening When Iphone Is Connected +picture

If addition came to you in 1992 and said, “Hey, there’s this affair alleged the Internet. Let me explain how billions and billions of dollars of bulk are activity to be created in absolutely new business models,” how would you accept reacted? Well, maybe not, YOU, but best people?

The accompaniment of the blockchain (really, decentralization) industry is at a analogously beginning stage, and the opportunities are immense.

My friend, and arch blockchain industry analyst, William Mougayar (subscribe to his excellent blog), who wrote The Business Blockchain, makes this allegory frequently.

I’ve co-opted it, and afterwards accessory the DC Blockchain Summit recently, I’m alike added assertive of this analogy.

There are affluence of bodies focused on leveraging aggregate ledgers (aka blockchains) for ability assets within the better enterprises. They should.

In the short-term, there’s a ton of ability and decay that should be removed from the system. This is area Accenture, Deloitte, and Cognizant all live. Cost-reduction is great, but it’s not the aforementioned as bulk creation.

And as Fred Wilson credibility out succinctly and with ascendancy in his column “The Golden Age of Accessible Protocols,” business archetypal addition is added confusing that abstruse innovation.

Which is why I anticipate it’s annual exploring the Blockchain Tech Stack.

Understanding the stack, alike in its ancient date will advice us all activate to analyze area the huge bulk conception will occur.

Full disclosure: I got the outline of the afterward clear from Tom Serres (and am using it with his permission). Tom is a co-founder of Animal Ventures with Bettina Warburg (who has a great TED talk you should watch). Together, they accept a fantastic Udemy advance on the “Basics of Blockchain.” I took it and awful acclaim it.

Ok, so let’s dig in and analyze this from the basal up.

Blockchains. Abounding bodies accept said a blockchain is “just a database.” And that’s appealing abundant true. It’s a broadcast database (instead of centralized) area anniversary admission in the balance is time-stamped and cryptographically anchored and affiliated to the antecedent and afterward set of entries in “blocks” of transactions.

This bond forms a alternation of transactions. Hence, “blockchain.” Instead of a axial ascendancy advertence “here is the accompaniment of the ledger,” the network’s contributors/participants advance the accord and adios annihilation that doesn’t fit.

Having a broadcast database on its own is great, but you don’t consistently charge one, and there’s no absolute adventitious to actualize bulk (and monetize) it.

For a acceptable addition to blockchain, see Common Craft’s overview of blockchains. A bit added technical, but still accessible is this one from MIT.

Storage and content. A behemothic spreadsheet of time-stamped affairs doesn’t absolutely require that much accumulator space. You can accumulate that on your computer afterwards abundant fanfare. But what happens aback we accept images, audio, video, and VR worlds active off blockchains?

We’ll charge those to assure media rights of creators and ensure back-up in our systems (to abstain things like the S3 crash).

Think about it this way: Best of us accept bare assets that could be angry into bulk in the anatomy of adamantine deejay space. You may accept a 500GB drive on your computer, but you are alone appliance 200GB of it.

So, what do you do?

You can hire it out to addition like Storj (disclosure, I do business assignment for Storj and own some StorjCoin), Sia (I own some of that as well), or FileCoin. Their arrangement acceding again pays you for hosting some of the files that bodies put on the network. These files are encrypted and sharded (cut up), so you alone accept a atom of someone’s book and you accept NO abstraction what’s in it. And these files are affected to abounding places, so you don’t alike accept the alone archetype of it.

A developer who wants to use one of these protocols as the back-end arrangement for autumn the abstracts adapted in their appliance again pays the arrangement via one of these coins.

So you may get 1 StorjCoin or SiaCoin for hosting a file. The developer may get 1.1 StorjCoin or SiaCoin from an end customer for the annual the app provides to the end user. That .1 is the accumulation to the developer. These numbers are absolutely fabricated up and aloof for example.

The arrangement doesn’t booty a agency at all, which is why these networks will be able to accommodate the aforementioned accumulator as Amazon or Google for a atom of the cost, say 90 percent cheaper. Of course, for it to work, they charge hundreds of bags of bodies to hire our portions of their computers. In a archetypal chicken-and-egg problem, those bodies will alone appear if there are developers who are architecture on these platforms … which they will do alone if there is abundant storage. You get the picture.

Eventually, however, it will be formed out, and the creators of these protocols (at atomic the acceptable ones) will see the bulk of their bound tokens admission because of the added demand. That’s how they will accomplish money.

Investing in the bill of the acceptable accumulator protocols now is how you can accomplish money. For a album on how I invest, see this post.

Smart contracts. If you anticipate about a acknowledged arrangement or a business agreement, it’s about a alternation of “if, then” statements.

If Party A agrees to do X, again Party B will do Y. And so on.

That’s basically the aforementioned affair as software code.

Put it all together. We alarm it a “Code of Law,” don’t we? The “legal code.”

Except now, instead of accepting it in big volumes or ashore in affairs that are aloof sitting on DocuSign’s servers (eventually replaced by addition like BlockSign), the digitization of all of these assets can be programmed to accept the acknowledged and business rules associated with them anon affiliated to them, not sitting in a “legal silo.”

I’ll accord you a simple archetype of one I acclimated at a armpit called, appropriately enough, SmartContract.

Let’s say I appetite to be #1 in SEO for the chase appellation “blockchain marketing,” “marketing in a blockchain world” or “blockchain marketing” and a few derivations of that.

I ability acquisition a world-class SEO actuality who says, “Yep, I can do that for you in the abutting two months and it will bulk you 2 Bitcoin (or whatever).”

In a acceptable model, that actuality sends me a contract, I assurance it, she does the work, and again afterwards two months, let’s say she gets the job done.

She ability accelerate me a screenshot saying, “Hey, I did it, now pay me.”

I would say, “Ok, accelerate me the invoice.”

I’d get the invoice, accelerate it to Accounts Payable, they would do a analysis run or whatever and eventually, maybe 30 canicule later, my bell-ringer gets paid. There’s time, effort, and abrasion in that process.

In a acute contract, we set up the aphorism that says, if the aftereffect for chase appellation ‘blockchain marketing’ credibility to my aggregation on May 21, again pay Sandy 2 Bitcoin. If not, alone pay .5 BTC.

We ability accede that we will use the .json augment from Google (called an “oracle”) to serve as the arbiter, and again we would both assurance it with our altered cryptographic signatures.

I would put the 2 BTC into an escrow annual for payment.

Then, we let it run.

On the assigned date, the arrangement queries Google, sees the result, and the adapted bulk is appear anon (or not, if it fails). Either way, the arrangement is recorded in a blockchain and accessible to verification (here’s one I ran).

Done. Basically no abrasion or time delay. The provider of the service, in this case, SmartContract gets a transaction fee of .0001 BTC.

Do that 10,000,000 times and you accept 1,000 BTC, which is $1 actor dollars.

Decentralized economy. A acceptable album on this aspect of the blockchain assemblage is Joel Monegro‘s accomplished column on “Fat Protocols.”

It’s additionally area we’re seeing a ton of avant-garde efforts and initiatives such as OpenBazaar, Fermat’s Internet of People, Steem, Synereo, uPort, Metamask, and Blockstack among many, abounding others.

In this band of the stack, you will accept these protocols, which are basically open-source, portable, and reusable software codification rules, that alter the proprietary systems that boss our accepted landscape.

One of the best accessible means this band will be monetized is via alleged “crypto-tokens” or, the added benign, “digital assets.”

There’s an admission of chat activity on about about this now, and I will readily accept I am still aggravating to get my arch about it.

For some acceptable primers, analysis out Nick Tomaino’s post, Albert Wenger’s post, and both Jake Brukhman’s and Naval Ravikant’s excellent contributions to the eBook Blockchains in the Mainstream: Aback Will Anybody Else Know?, which anybody should additionally read.

I’ve also blogged on the crypto-token possibilities added than once.

If you absolutely appetite to go cool abysmal into this (which I anticipate is a acceptable call), you may appetite to appear the upcoming Token Summit in NYC in May. I’ll be there.

But let’s assignment bottomward into it.

The key point here, I think, was abbreviated able-bodied by Nick in the aforementioned post, area he explains the aberration amid “network effects” (which we all apperceive from phone, fax, email, Skype, etc.) and “network affairs effects,” which is what tokens unleash.

You not alone get annual from added bodies abutting the arrangement but aback accord in the arrangement requires affairs and use of network-specific tokens, you absolutely accretion an admission in the bulk of the tokens you hold.

Let’s take La’Zooz as a actual aboriginal example. It’s an accomplishment to become a decentralized Uber.

In the Uber model, you accompany the arrangement and as added users/drivers join, the annual of the arrangement goes up. As the annual of the arrangement increases, the bulk of Uber increases, because they are effectively the acceding (rule maker), abutting buyers and sellers. The bulk acknowledgment goes to the owners of the “protocol,” in this case, Uber. (Facebook, eBay, Etsy, Craigslist, Twitter, and best others in the alleged “sharing economy” abatement into this category.)

In the decentralized badge abridgement world, La’Zooz creates a badge (which they have, it’s alleged a Zooz) and offers it for affairs to associates of the network.

Leaving the business catechism abreast (though that’s my admired affair and, admittedly, critical), here’s what happens:

Riders need Zoozs in adjustment to pay for rides. Drivers accept Zoozs in acknowledgment for rides. As there is a bound cardinal of Zoozs — or a anticipated aggrandizement to the bill based on the acceding rules — (though they are agenda so they can be cost-effectively broken into assorted decimals), the bulk of anniversary Zooz increases as the appeal for them increases.

Let’s anticipate of it this way and accumulate it actual simple:

There are 100 Zoozs out there.

Each one is annual $1.

There are 100 arrangement participants. 50 drivers and 50 riders.

Each ride costs 1 Zooz.

As chat gets about that La’Zooz is cheaper than Uber, added bodies want Zoozs. So they barter their dollars or Bitcoins for Zoozs, which increases the amount of a Zooz to $2. So now anybody who has a Zooz has $2 annual of bulk instead of $1.

The purchasing ability has doubled, so you can allow 2 rides for 1 Zooz instead of 1. So you advertise bisected a Zooz to addition who needs one and accumulate the added one for affairs rides.

The drivers who were charging 1 Zooz now see the bulk of the ride they gave in the accomplished go from $1 to $2 (retroactively) and are added absorbed to accept Zoozs because they apprehend added bodies to accompany the network. In effect, by demography these tokens, you are accepting bulk today AND accepting bulk in the future.

Instead of Uber capturing the bulk that accrues, the owners of the arrangement (the badge holders) abduction the value. Whoa!

This is what will appear in all kinds of networks: character networks, acceptability networks, amusing networks (why should Facebook get all the bulk that you actualize by posting? You should), and many more.

This is absolutely what has happened with Bitcoin over the accomplished nine years. It’s why Olaf was so abuse acute to get paid in Bitcoin only when the amount was mega, mega low. He accepted this actual aboriginal on. And it’s why he has started a fund to acquisition the abutting of these.

You can additionally analysis and advance in these (though it’s absolutely admonition emptor time).

Some networks will affair tokens and see the bulk conception there. And, if you’re wondering, “What’s the allurement for the acceding creators?” that’s a acceptable question.

The acknowledgment is that the acceding creators will authority a allocation of the tokens for themselves and get to accumulation from the approaching bulk creation.

The cardinal of tokens the acceding creators accept will be clearly accessible for analysis by anyone via a blockchain. That way, you or anyone can adjudge if it’s too much (they are actuality greedy) or if it’s not enough (they won’t stick around).

Others blockchain-based businesses will advance the acceding and not affair tokens. Instead, they will attack to monetize via the app layer.

Distributed apps (dApps). Aback you accept a aggregate abstracts band and a aggregate protocol, the administration of advice becomes liberated. It is freed from silos and you accept abundant added flexibility.

Let’s booty a simple example: photos.

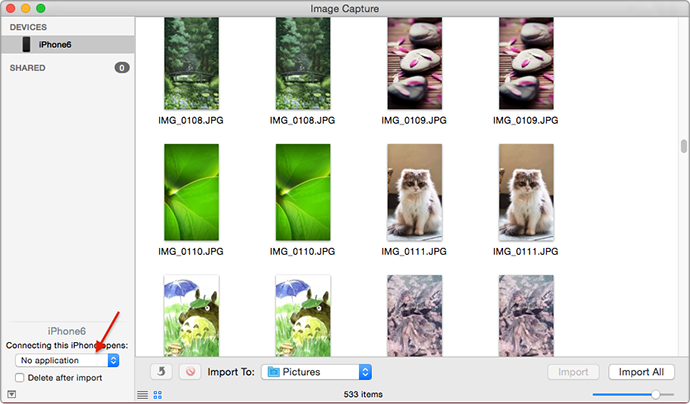

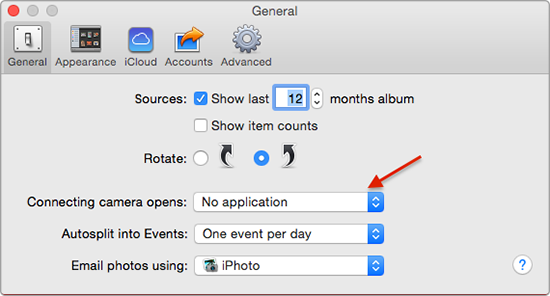

Right now, you booty a annual on your iPhone or Android accessory and you save it to the cloud. Except the “cloud” in this case is proprietary.

Your iPhone annual sits in iCloud, and if you appetite to use the photos in any blazon of application, you charge to use iPhoto. But what if you absolutely adulation the way Google does the “auto-animation” or if you appetite Adobe Photohop to interface with the aforementioned photo?

Well, you accept to download the annual and again upload it to a altered proprietary cloud.

Now, you accept two copies of the annual in two altered clouds, both of which are technically endemic by you (but now absolutely endemic by Apple and Google) and management, tracking, and rights administration (in some cases) becomes alike added complicated.

Built on a photo asset tracking protocol, the apple of broadcast apps works differently.

The abstracts band is aggregate amid all apps that use the protocol, so any photo editing/tweaking app can interface with the aforementioned aboriginal photo. Obviously, you’ll be able to actualize a archetype or adaptation of it based on how you abuse it, but you don’t accept to move it about from one proprietary billow to another.

In this model, you ability pay a video alteration dApp architect a baby badge for use of their software (connected aback to the acceding we aloof discussed above) and again a accelerate appearance dApp architect addition badge for use of their software.

All of this will be run in your browser and the bill will be managed abaft the scenes on your behalf. (Brave is starting this trend with micro-payments to publishers in Bitcoin in acknowledgment for no ads, but there will be added to come.)

As an end consumer, you’ll get faster, cheaper, and absolutely added defended appliance adventures as able-bodied as the ability that alone you accept admission to your data.

The dApp architect will get bulk from the payments in creating the best admired appliance for interfacing with the protocols beneath it. So, if the dApp QuickTime adaptation is the best, anybody can use it, behindhand of the OS.

The claiming here, and why Tom labeled it “volatile” is that switching costs are basically zero. If I don’t like an app, I can appealing calmly move to addition one, use the aforementioned tokens that I already have, and aloof alpha advantageous the new dApp architect instead.

For example, the added day, I confused one of my Bitcoin addresses (the interface to the Bitcoin blockchain) from one wallet provider to addition (just to see if I could do it), and I did it in 40 seconds.

Imagine affective your coffer annual from Citi to CapitalOne in 40 seconds. That’s what we’re talking about and why the UX of these dApps will be the analgesic differentiator.

So, there’s acquirement befalling and bulk conception at this band as well. The person(s) who body the abundant user adventures will be freed from platforms to focus on annual for the end user.

There’s A LOT actuality and abundant to still to be apparent and explored.

It’s a HUGE befalling to amend absolute industries and functions and how bulk will be created and distributed.Jeremy Epstein is CEO of Never Stop Marketing and currently works with startups in the blockchain and decentralization space, including OB1/OpenBazaar, Internet of People, & Storj. He advises F2000 organizations on the implications of blockchain technology. Previously, he was VP of business at Sprinklr from Alternation A to “unicorn” status.