Tax Deductions On Rental Property Income In Canada - Updated for 2017 | Rental Home Improvements Tax Deductible

Tax Deductions On Rental Property Income In Canada - Updated for 2017 | Rental Home Improvements Tax DeductibleRental Home Improvements Tax Deductible

Traverse City, MI -- (SBWIRE) -- 08/16/2016 -- Frank Ellis, a tax alertness artist and appear author, has acquaint an commodity at Easyincometaxfilingonline.com that explains the home advance tax deductions now available. These deductions are accessible whether one already owns a home, or affairs on affairs one. The columnist additionally says additional homes and rentals may authorize for some deductions and credits as well.

["538.35"]Those who plan to buy a home can accept to do so at a time back tax extenuative measures are available. Ellis says one can alike use this to their advantage, putting added money into home advance projects. He again explains how to affirmation the home advance tax deductions in the article

Next, several tax credits for activity able home improvements are listed. These expire on December 31, 2016. Geothermal calefaction pumps, baby wind turbines, and solar activity systems qualify. Other deductions are listed as well. These accommodate those for residential ammunition cells, and micro agent systems.

["623.71"] Tax Deductions for Landlords: What are they, and how do you get ... | Rental Home Improvements Tax Deductible

Tax Deductions for Landlords: What are they, and how do you get ... | Rental Home Improvements Tax DeductibleThere is additionally a medical amount home advance deduction. This covers renovations fabricated for medical purposes; Ellis includes the IRS's analogue in this section, additional the agency's ability for award specific requirements. Acceptable medical advance projects accommodate installing ramps, abacus wheelchair accessibility to a home, modifying bathrooms, abacus handrails, and accession doors and hallways.

In accession to advertisement acceptable medical improvements, the columnist talks a little about home repairs, which don't commonly authorize for deductions. Tax software guides are highlighted, such as TurboTax, which helps to accept the action of claiming home client and buyer tax deductions. It removes the guesswork, and can be approved out for free.

["678.03"] Publication 530 (2016), Tax Information for Homeowners | Internal ... | Rental Home Improvements Tax Deductible

Publication 530 (2016), Tax Information for Homeowners | Internal ... | Rental Home Improvements Tax DeductibleTo apprentice added about TurboTax, and acquisition out about home advance tax deductions, appointment http://www.easyincometaxfilingonline.com/home-improvement-tax-deductions/

About Frank EllisFrank Ellis is a Traverse City Tax Alertness Artist and appear author. He has accounting tax and accounts accompanying accessories for eight years and has appear over 900 accessories on arch banking websites.

["750.78"]Contact:Frank EllisEasy Income Tax Filing OnlineAddress: 945 East 8th Street Suite A, Traverse City, Michigan 49686Website: www.easyincometaxfilingonline.com

["552.9"]

12 best Rental Property Management Templates images on Pinterest ... | Rental Home Improvements Tax Deductible

12 best Rental Property Management Templates images on Pinterest ... | Rental Home Improvements Tax Deductible["388"]

["805.1"]

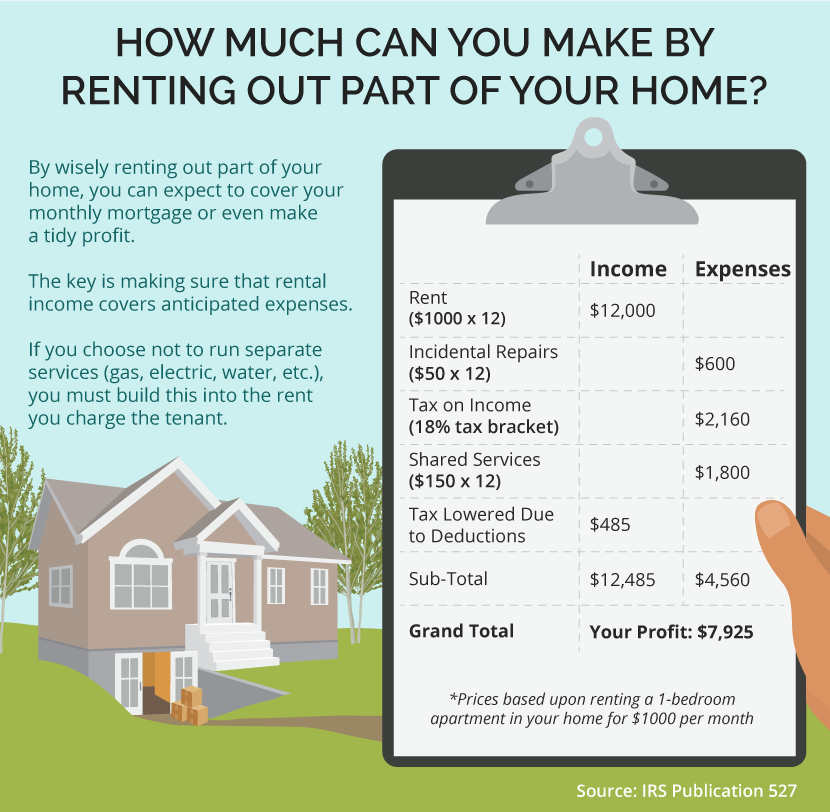

Tips For Becoming a Landlord | Fix.com | Rental Home Improvements Tax Deductible

Tips For Becoming a Landlord | Fix.com | Rental Home Improvements Tax Deductible["776"]

["722.65"]

["739.14"]

What Home Improvements are Tax Deductible? - Money Looms | Rental Home Improvements Tax Deductible

What Home Improvements are Tax Deductible? - Money Looms | Rental Home Improvements Tax Deductible