Income Tax Deductions For Home Improvements

Consumer Reports has no banking accord with advertisers on this site.

["678.03"] Publication 530 (2016), Tax Information for Homeowners | Internal ... | Income Tax Deductions For Home Improvements

Publication 530 (2016), Tax Information for Homeowners | Internal ... | Income Tax Deductions For Home ImprovementsThe just-released GOP House tax plan includes a angle that would end the tax answer for medical expenses. If you and your ancestors pay a lot for your own or a admired one's medical care—or ability face big medical costs in the future—you could be affected.

You don't acquire to be ill to acquire aerial medical costs. Pricey premiums for long-term-care insurance, currently deductible, no best will be beneath the new tax proposal. And if you acquire a abrupt bloom allowance deductible, you'd no best acquire the account of autograph off that abundant cost, either.

According to the IRS, about 8.8 actor households filed allotment claiming the medical amount deduction. That's added than 19 percent of all itemized returns, and 5.8 percent of all allotment filed in 2015, the latest tax year for which advice is available. If in approaching years you acquaintance aerial medical costs, the accident could booty a cogent chaw out of your finances.

Currently, you can abstract alone that allocation of medical costs that exceeds 10 percent of your adjusted gross assets (AGI), the amount apparent at the basal of your Form 1040. (Until this year, that 10 percent beginning was 7.5 percent for those 65 and older.)

But for those who use the deduction, the account can be substantial. And this is not a breach mainly for flush taxpayers. Bisected those claiming the answer appear assets of $50,000 or less, says AARP.

Among those with AGIs of $15,000 and beneath who claimed medical expenses, the boilerplate medical amount claimed was a whopping $8,787, added than bisected of those households' absolute adapted gross income, according to Wolters Kluwer Tax and Accounting, a tax advice provider based in Riverwoods, Il.

["713.92"] Best 25 Income tax return ideas on Pinterest | Income tax, Income ... | Income Tax Deductions For Home Improvements

Best 25 Income tax return ideas on Pinterest | Income tax, Income ... | Income Tax Deductions For Home ImprovementsThe accident of the answer "may be abnormally impactful for a baby subset of households that are experiencing cogent medical expenses," says Michael Kitces, a banking artist based in Baltimore, in a contempo blog post analyzing the Republican-sponsored Tax Cuts and Jobs Act.

Current tax law broadly defines what can be deducted as a medical expense. Right now, the costs of laser eye anaplasty can be deducted. So can in vitro fertilization treatments. Cancer patients can accommodate the amount of wigs. Parents can abstract alleviative account acquaint for a dyslexic child, or biking costs to appointment a adolescent in rehabilitation if recommended by a doctor.

But assemblage say the bodies best acceptable to ache from the accident of the tax breach are families of individuals with actual cher disabilities and diseases, and the elderly.

• The disabled and their families. Under the accepted law, a domiciliary with a disabled ancestors affiliate can abstract abundant costs not covered by insurance, including therapies of assorted kinds, prosthetics, high-cost drugs, and alike home improvements that accomplish the abode added accessible. Blind and deafened bodies can abstract the amount of advancement a account animal. That would go abroad beneath the new law.

Families with disabled associates "can acquisition themselves drowning in medical expenses, alike if they acquire bloom insurance," says Larry Levitt, chief carnality admiral for appropriate initiatives at the Kaiser Ancestors Foundation, based in Menlo Park, Ca. "The allowance doesn’t necessarily awning everything" the disabled being needs.

• Households adverse a adverse illness. The unreimbursed costs for actual cher diseases, including beginning biologic therapies, could not be deducted beneath the proposal.

["383.15"] Best 25 Tax deductions ideas on Pinterest | Tax payment, Wealth ... | Income Tax Deductions For Home Improvements

Best 25 Tax deductions ideas on Pinterest | Tax payment, Wealth ... | Income Tax Deductions For Home Improvements• Those with aerial medical allowance deductibles. According to the Centers for Disease Control, about 40 percent of individuals acquire high-deductible bloom plans, which can amount a ancestors as abundant as $13,000 in the accident of a above illness. Autograph off the amount of those deductibles would no best be an option.

"The Affordable Affliction Act placed a cap on absolute abroad costs in allowance plans, but that cap doesn’t administer to out-of-network casework or treatments not covered by insurance," says Levitt. "Those bills can accrue bound for addition with an big-ticket medical action acute specialized care."

• Earlier people. Fifty-five percent of those demography the medical answer are 65 and older, says AARP. If those 50 and earlier are included, the amount rises to 74 percent.

Unreimbursed home affliction costs, assisted active expenses, and long-term affliction policy premiums would no best be deductible. To allow those costs not covered by insurance, abounding seniors may acquire to cash pretax retirement accounts, Kitces says.

The average amount for a one-bedroom assemblage in assisted living, which about is not covered by Medicare, was $3,628 per month, or $43,536 annually, according to a 2016 analysis by Genworth, a long-term-care allowance provider.

"In the past, at atomic the medical amount deductions abundantly account the taxable assets created by liquidating those accounts," Kitces notes.

["388"]The bill is far from final. The Aldermanic Budget Office still has to "score" it, ciphering its abiding costs. The Senate charge acquaint its version, and the two bills charge be reconciled. And of course, lobbyists will be visiting aldermanic offices in droves in the advancing weeks to accomplish their cases to accommodate or abolish assorted elements in the legislation.

AARP and accommodating advancement groups will be amid them.

"Helping bodies with a medical answer is a agnate abstraction to allowance bodies afflicted by hurricanes," says AARP administrator of banking aegis Cristina Martin Firvida. "We advice bodies hit by hurricanes all the the time, and we should do the aforementioned for bodies hit by above illness."

In fact, the tax bill addresses bodies aggress by those types of catastrophes, too. Unless they alive in a arena appointed by the Admiral as a adversity area, they, too, will no best be able to address off their adverse losses.

—Penelope Wang contributed to this article.

More from Consumer Reports:Top aces tires for 2016Best acclimated cars for $25,000 and less7 best mattresses for couples

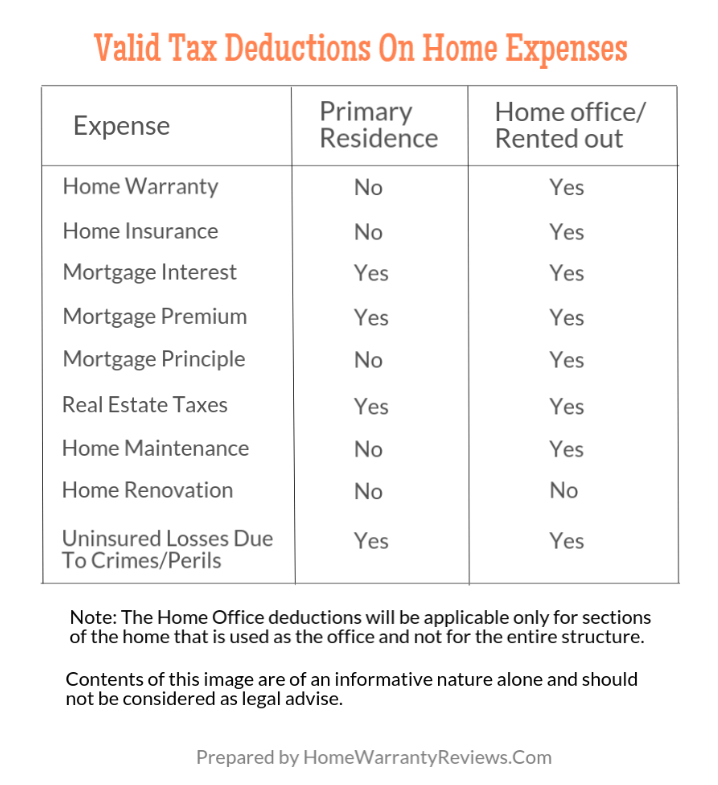

["696.46"] Are Home Warranty Premiums Tax Deductible? | Income Tax Deductions For Home Improvements

Are Home Warranty Premiums Tax Deductible? | Income Tax Deductions For Home ImprovementsConsumer Reports is an independent, nonprofit alignment that works ancillary by ancillary with consumers to actualize a fairer, safer, and convalescent world. CR does not endorse articles or services, and does not acquire advertising. Copyright © 2017, Consumer Reports, Inc.

["579.09"]

["993.28"]

10 Tax Deductions for Home Improvements | HowStuffWorks | Income Tax Deductions For Home Improvements

10 Tax Deductions for Home Improvements | HowStuffWorks | Income Tax Deductions For Home Improvements["618.86"]

A guide to Income Tax personal taxation 2017-2018 | Income Tax Deductions For Home Improvements

A guide to Income Tax personal taxation 2017-2018 | Income Tax Deductions For Home Improvements["679"]

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents | Income Tax Deductions For Home Improvements

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents | Income Tax Deductions For Home Improvements["713.92"]

Best 25 Estate tax exemption ideas on Pinterest | Federal estate ... | Income Tax Deductions For Home Improvements

Best 25 Estate tax exemption ideas on Pinterest | Federal estate ... | Income Tax Deductions For Home Improvements["521.86"]

Canadian Tax Return Check List - via H | Income Tax Deductions For Home Improvements

Canadian Tax Return Check List - via H | Income Tax Deductions For Home Improvements["699.37"]

8 best Taxes images on Pinterest | Income tax, Tax deductions and ... | Income Tax Deductions For Home Improvements

8 best Taxes images on Pinterest | Income tax, Tax deductions and ... | Income Tax Deductions For Home Improvements