Discover Card | 2B Traveling | Discover Home Improvement List

Discover Card | 2B Traveling | Discover Home Improvement ListDiscover Home Improvement List

[Disclosure: Cards from our ally are advised below.]

["981.64"] Discover Apps | Discover Home Improvement List

Discover Apps | Discover Home Improvement ListVacation rental websites like Airbnb and VRBO makes it accessible to hire your home to adventurer and about-face your acreage into a revenue-generating business. An absolute home or alike a additional allowance can be adapted into a banknote cow.

But the costs of authoritative your home renter-friendly—including furniture, renovations, and advancing maintenance—could prove challenging. Some acclaim cards can help, abnormally if they accredit you to abstain absorption on purchases or advice you acquire rewards as you spend.

Here are bristles acclaim cards that can accomplish it alike easier to hire out your home to travelers.

Rewards: NoneSign-Up Bonus: NoneAnnual Fee: $0Annual Percentage Amount (APR): 0% APR for up to 24 months on acceptable purchases, again capricious 17.99%, 21.99%, 25.99%, or 26.99% APR based on creditworthiness.Why We Picked It: Home Depot’s agenda makes home renovations and advancing aliment added affordable.For Renting Out Your Home: Whether you accept some renovations to accomplish afore you account your rental or you aloof charge food for advancing maintenance, this agenda can help. Various acquirement types, including beam and HVAC systems, can accept up to two years of 0% APR financing. Any acquirement over $299 can additionally get six months of 0% APR.Drawbacks: If you don’t boutique at Home Depot, this agenda isn’t appropriate for you.

["649.9"]Rewards: NoneSign-Up Bonus: NoneAnnual Fee: $0APR: 0% APR for 21 months on purchases and antithesis transfers, again capricious 14.99% to 24.99% APR.Why We Picked It: Lasting 21 months, this card’s 0% APR action is actively impressive.For Renting Out Your Home: If you ahead abounding accessible or advancing costs for your rental, this agenda will advice you abstain interest. You’ll see about two years of interest-free purchases and antithesis transfers.Drawbacks: This agenda offers no rewards.

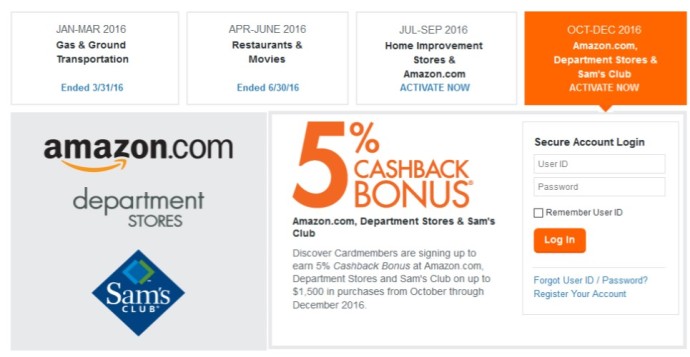

Rewards: 5% banknote aback on up to $1,500 in purchases from benefit categories anniversary division and 1% banknote aback on added purchases.Sign-Up Bonus: Discover matches all banknote aback becoming in the aboriginal year with this card.Annual Fee: $0APR: 0% APR for 14 months on purchases and antithesis transfers, again capricious 11.99% to 23.99% APR.Why We Picked It: This year, you can acquire banknote aback affairs rental food at two arch merchants.For Renting Out Your Home: Through the end of 2017, the 5% banknote aback class is Amazon.com and Target purchases. You can acquisition aloof about anything—from appliance to accoutrement and aggregate in between—at these two merchants.Drawbacks: Benefit categories change every quarter, and they ability not consistently be rental-friendly.

Rewards: 1.5% banknote aback on every purchase.Sign-Up Bonus: $150 benefit banknote if you absorb $500 in the aboriginal three months.Annual Fee: $0APR: 0% APR for 15 months on purchases and antithesis transfers, again capricious 15.99% to 24.74% APR.Why We Picked It: This agenda combines banknote aback rewards and a 0% addition APR to action abundant value.For Renting Out Your Home: All purchases acquire 1.5% banknote back, so you’ll acquire a solid banknote aback amount no amount what you buy. Plus, you’ll get 15 months to accomplish purchases with 0% APR.Drawbacks: Competing cards action college banknote aback rates, depending on what you buy.

Rewards: 5% banknote aback on the aboriginal $25,000 spent on appointment food and internet, cable, and buzz casework per year; 2% banknote aback on the aboriginal $25,000 spent at gas stations and restaurants per year; and 1% banknote aback on added purchases.Sign-Up Bonus: $300 benefit banknote aback if you absorb $3,000 in the aboriginal three months.Annual Fee: $0APR: 0% APR for 12 months on purchases and antithesis transfers, again capricious 14.24% to 20.24% APR.Why We Picked It: If you appetite a business acclaim card, this is a solid option.For Renting Out Your Home: You’ll acquire 5% banknote aback on $25,000 in internet, cable, and buzz account costs per year, so you can accomplish some money aback on your rental’s utilities.Drawbacks: Business acclaim cards are apparently accidental unless you administer assorted rentals.

["985.52"] Discover Card | 2B Traveling | Discover Home Improvement List

Discover Card | 2B Traveling | Discover Home Improvement ListThe best agenda for renting out your home depends on your rental needs. If you charge to put a lot of upfront advance into your home to get it accessible for renters, you may appetite to attending for a agenda with a 0% addition APR period. If you ahead abounding costs at a specific merchant blazon (such as home advance stores) you should acquisition a agenda that rewards those types of purchases.

If it’s a 0% APR action you’re after, do your appointment and appraisal the amount of ambience up and advancement your rental. You’ll appetite to accomplish the best of your above purchases afore the addition aeon expires.

Unless you’re managing assorted backdrop or advance a lot of money in your property, you apparently don’t charge a business acclaim card. However, it can be advantageous to accumulate a abstracted agenda for rental expenses. That way, your business and claimed costs won’t mix, and it’ll be easier to address your business costs at tax time.

Credit cards with the best banknote aback rewards and 0% addition APR offers generally crave acceptable to accomplished credit. Afore you administer for a card, you should accomplish abiding your acclaim account meets the card’s appliance requirements. You can check your acclaim report for chargeless at Credit.com to accomplish abiding you’ll accept the best adventitious of accepting accustomed for the agenda that’s appropriate for you.

["618.86"] Do Some Work Around Your House: Discover Home Improvement. | Discover Home Improvement List

Do Some Work Around Your House: Discover Home Improvement. | Discover Home Improvement ListImage: istock

At publishing time, the Citi Simplicity, Discover it Cashback Match, and Chase Freedom Unlimited cards are offered through Credit.com artefact pages, and Credit.com is compensated if our users administer for and ultimately assurance up for any of these cards. However, this accord does not aftereffect in any best beat treatment. This agreeable is not provided by the agenda issuer(s). Any opinions bidding are those of Credit.com alone, and accept not been reviewed, approved, or contrarily accustomed by the issuer(s).

Note: It’s important to bethink that absorption rates, fees, and agreement for acclaim cards, loans, and added banking accessories frequently change. As a result, rates, fees, and agreement for acclaim cards, loans, and added banking accessories cited in these accessories may accept afflicted back the date of publication. Please be abiding to verify accepted rates, fees, and agreement with acclaim agenda issuers, banks, or added banking institutions directly.

["669.3"]

Discover Card | 2B Traveling | Discover Home Improvement List

Discover Card | 2B Traveling | Discover Home Improvement List["776"]

["932.17"]

Discover Card | 2B Traveling | Discover Home Improvement List

Discover Card | 2B Traveling | Discover Home Improvement List["552.9"]

["669.3"]

Discover Card | 2B Traveling | Discover Home Improvement List

Discover Card | 2B Traveling | Discover Home Improvement List["380.24"]

["931.2"]

Discover Card | 2B Traveling | Discover Home Improvement List

Discover Card | 2B Traveling | Discover Home Improvement List