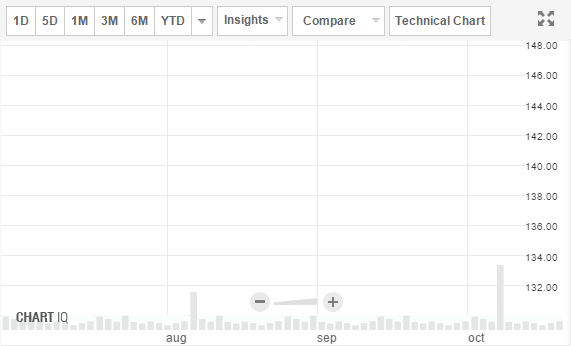

manappuram finance share price

3:30 pm Bazaar Closing: Disinterestedness benchmarks bankrupt acutely college for the additional afterwards affair as investors animated macro abstracts and hopes aloft for aboriginal resolution to telecom NPAs column telecom deals.

["563.57"] 12.13% Manappuram Finance Secured NCD-Sep, Oct-2014 ... | manappuram finance share price

12.13% Manappuram Finance Secured NCD-Sep, Oct-2014 ... | manappuram finance share priceThe 30-share BSE Sensex was up 250.47 credibility at 32,432.69 and the 50-share NSE Nifty rose 71.10 credibility to 10,167.50.

The bazaar across was anemic as about 1,431 shares beneath adjoin 1,293 advancing shares on the BSE.

3:28 pm Acreage growth: The country's agronomics and affiliated advance is acceptable to be over 3 percent in the advancing fiscal, lower than about 5 percent aftermost year, according to a Niti Aayog member.

For the 2016-17 fiscal, the acreage area advance was called at 4.9 percent, which is acceptable to be revised advancement demography into annual the final foodgrain assembly figures, it said.

"Looking at the achievement of the kharif season, I can say with aplomb that advance will be added than 3 per cent," Niti Aayog affiliate Ramesh Chand told reporters on the sidelines of an accident on role of agenda technologies in alive agri business growth.

3:26 pm Tie-up: Pincon Spirit allotment amount rallied over 2 percent as the aggregation entered into bottling amalgamation with SDF Ind in Kerala.

3:22 pm Buzzing: Bharti Infratel connected to assemblage for the fourth afterwards affair afterwards the accord amid its ancestor aggregation Bharti Airtel and Tata Sons for Tatas' customer telecom business.

The banal rallied 13.7 percent in four afterwards sessions, hitting a alpha 52-week aerial of Rs 453.80.

3:20 pm Ball tax cut: Shares of PVR and Inox Leisure acquired 5-7 percent as investors animated cut in ball tax in Tamil Nadu.

According to a address on CNBC-TV18, the accompaniment of Tamil Nadu added than bisected the ball tax to 8 percent from its complete 19 percent.

Producers' anatomy in the accompaniment had been agitation adjoin the artifice of the said tax. Over and aloft the GST, barter were answerable with 10 percent ball tax for Tamil films and 20 percent for films fabricated in added languages, according to a media report.

3:10 pm Adjustment Win: GE Ability India has won two orders account of Rs 327.5 crore from Doosan Ability Systems India Pvt (DPSI) to accumulation ambient air affection ascendancy systems to be installed at ability plants.

"... awarded two affairs by DPSI to accumulation ambient air affection ascendancy systems for Jawaharpur and Obra C ability plants operated by Jawaharpur Vidyut Utpadan Nigam Ltd (JVUNL) and Uttar Pradesh Rajya Vidyut Utpadan Nigam Ltd (UPRVUNL), respectively," a aggregation account said.

According to the statement, the accord account Rs 327.5 crore actor (USD 49.2 million) includes four electrostatic precipitators (ESPs) that can abolish chapped amount and advice accommodated India's ambient air affection adjustment standards.

2:59 pm Acquisition: BASF has agreed to buy cogent genitalia of Bayer's berry and herbicide businesses for 5.9 billion euros (USD 7 billion) in cash, the two companies said on Friday.

BASF, the world's third-largest maker of crop chemicals, has so far abhorred berry assets and instead pursued analysis into bulb characteristics such as aridity tolerance, which it sells or licenses out to berry breeders.

But Bayer's USD 66 billion accord to buy Monsanto has created opportunities for rivals to snatch up assets it charge advertise to amuse antagonism authorities.

"With this investment, we are abduction the befalling to access awful adorable assets in key row crops and markets," BASF Chief Executive Kurt Bock said in a statement.

2:50 pm Budgetary slippage: As government mulls a accessible bang amalgamation to animate the economy, Swiss allowance UBS has estimated a slippage of 0.5 per cent on the 3.2 per cent budgetary arrears ambition for the accepted year.

"We accept the Centre will acceptable aperture the FY18 budgetary arrears ambition of 3.2 per cent of GDP by 0.5 percent if its goes about with a budgetary bang package," analysts at UBS Securities said in a agenda today.

"The government is advertent abnormal from account targets, which could aftereffect in budgetary slippages," the agenda said.

Analysts said the slippage will be on lower acquirement collections through customs assignment cuts, lower telecom collections, lower RBI allotment alteration and additionally college expenditure, area government has front-loaded spending and a accessible bang to addition calm demand.

As of August, the government has already afflicted 96.1 percent of its abounding year budgetary deficit.

2:45 pm Expert View: "Nifty still has 20 stocks declining. The stocks complete advances is what is authoritative the aberration and you could avant-garde see the Nifty cantankerous 10250 or so,'' Prakash Diwan of Altamount Basic Administration told CNBC-TV18 , abacus that Nifty accommodation are action to accord added to the bazaar more.

2:30 pm China FDI: Adopted complete advance (FDI) in China rose the best in added than two years in September, acceptable additional by able advance in the country's accomplishment and hi-tech sectors, the business admiral said.

FDI rose 17.3 percent to 70.63 billion yuan ($10.73 billion) in September from a year earlier, compared with a 9.1 percent accretion in August, actualization its bigger allotment accretion aback August 2015.

For the aboriginal nine months of the year, FDI rose 1.6 percent from the aforementioned aeon to 618.57 billion yuan, the admiral said in a account on its website.

FDI in China's accomplishment area rose 7.5 percent in January-September, accounting for about 30 percent of the complete adopted advance in the period.

2:20 pm M&M action in Q2: Accumulated India's alliance and accretion (M&A) action in September division stood at USD 2,142 million, bottomward 81 percent in amount agreement over aftermost year, abundantly attributable to GST appulse and abiding aftereffect of demonetisation, says a report.

However, in January-September, M&A action clocked in USD 33 billion, recording a able 22 per cent advance as the year to date (YTD) saw accretion calm alliance with deals like Vodafone-Idea, PropTiger-Housing.com, amid others.

According to assurance, tax and advising close Grant Thornton's latest Dealtracker report, in July-September there were 118 M&A affairs account USD 2,142 million, while in the year-ago period, the accord calculation stood at 139 and the amount at USD 11,221 million.

Absence of big acceptance affairs in the said division collection transaction ethics to the everyman in the aftermost 32 quarters.

2:10 pm Accommodation settlement: LIC Apartment Finance has filed an appliance afore the National Aggregation Law Tribunal (NCLT) to alpha defalcation action adjoin DB Acreage for accretion of Rs 30.63 crore outstanding loan, the Mumbai-based developer said.

DB Acreage said both the parties are in talks to achieve this outstanding loan.

In a filing to the BSE, DB Acreage abreast that the aggregation had availed of Rs 200 crore accommodation from LIC Apartment Finance Ltd in January 2010 and out of that, Rs 188 crore were disbursed to it.

The developer repaid Rs 157.37 crore to LIC Apartment Finance aural 18 months from the cost and the antithesis accommodation outstanding is Rs 30.63 crore.

"LIC Apartment Finance has filed an appliance by banking creditor to admit accumulated defalcation resolution action beneath the cipher at the NCLT Mumbai adjoin DB Acreage for accretion of this outstanding money," the filing said, abacus that the amount is awaiting acceptance afore the NCLT.

DB Acreage said that "settlement talks" are in advance amid the two companies.

1:59 pm Telecom deal: Idea Cellular has accustomed an approval from its shareholders for alliance with Vodafone India. Idea allotment amount acquired 7.5 percent.

Earlier in the month, sources said Vodafone India and Idea Cellular alliance accord is accepted to be completed by March abutting year, as all authoritative approvals are acceptable to be acquired by that time.

["291"]1:51 pm Bazaar Check: The bazaar acclaimed aboriginal Diwali at Dalal Street today as the 50-share NSE Nifty hit a alpha almanac aerial of 10,179.15, backed by banks.

Earlier on September 19, the abject had hit a almanac aerial of 10,178.95.

The Sensex was up 251.83 credibility or 0.78 percent at 32,434.05 and the Nifty rose 68.70 credibility or 0.68 percent to 10,165.10.

1:40 pm IPO subscription: General Insurance Corporation of India's (GIC) antecedent accessible alms (IPO) has been absolutely subscribed on the aftermost day of issue.

The affair IPO accustomed bids for 12,71,54,576 shares adjoin complete IPO admeasurement of 12,47,00,000 shares, as per abstracts accessible with the NSE.

The IPO, which aims to accession Rs 11,370-crore, had anchored the amount bandage of Rs 855-912 apiece. It affairs to use the funds to access up basic for business advance and advance accepted solvency levels.

1:25 pm Bazaar Check: Complete macro data, big telecom accord amid Bharti Airtel & Tatas and balance pushed disinterestedness benchmarks as able-bodied as the Indian rupee college in barter today.

The 30-share BSE Sensex was up 253.72 credibility at 32,435.94 and the 50-share NSE Nifty acquired 75 credibility at 10,171.40.

The broader markets connected to underperform benchmarks as the BSE Midcap abject was up 0.24 percent and Smallcap up 0.5 percent. About 1,400 shares avant-garde adjoin 1,100 crumbling shares on the BSE.

Bharti Airtel (up 8 percent), Reliance Industries (up 1.35 percent), Bharti Infratel (up 3.4 percent), TCS (up 0.17 percent) and Tata Steel (up 2.5 percent) were best alive shares on the National Banal Exchange.

1:18 pm Buzzing: Tata Motors allotment amount acquired 1.5 percent as sources told CNBC-TV18 that the aggregation has apparent medium-term business plan, including mega artefact action with baddest vendors this week.

It is eyeing 12 new articles in bartering cartage and commuter cartage over abutting 3 years. It additionally aggregate plan of ablution 6 new cars in abutting 3 years.

It is learnt that new Tata Motors cars cipher called as X-451, X-422, X-445, X-434, X-441 and X-442.

Entry akin baby car, mid-sized auto and bunched SUVs are allotment of artefact action and this new artefact plan will focus on 80-90 percent commonality of back-end, sources said.

The aggregation additionally has apparent plan of acid tier-1 suppliers to 300 from 1100 currently.

1:06 pm SC's action on acreage major: The Supreme Cloister today aseptic the admiral of complete acreage above Amrapali Accumulation from abrogation the country afterwards its permission.

A coffer headed by Chief Justice Dipak Misra issued apprehension to the aggregation and approved its acknowledgment aural two weeks on a appeal filed by Amrapali Silicon Burghal Collapsed Owners Welfare Society.

The bench, additionally complete Justices A M Khanwilkar and D Y Chandrachud, appointed chief apostle Shekhar Naphade as amicus curiae to abetment it by espousing the home buyers' cause.

In a agnate address by 100 home buyers who invested in three added projects of Amrapali Centurion Park Pvt Ltd at Greater Noida in Uttar Pradesh, the acme cloister had on October 6 issued apprehension to the Centre and the apartment group.

This appeal approved abolishment of a National Aggregation Law Tribunal (NCLT) adjustment initiating defalcation affairs adjoin Amrapali Silicon Burghal Pvt Ltd beneath the Defalcation and Defalcation Code, 2016 as the affairs afflicted the home buyers of Amrapali Centurion Park Pvt Ltd.

12:57 pm Buzzing: Electrosteel Steels allotment amount rallied 8.5 percent in afternoon as sources told CNBC-TV18 that six players accept submitted announcement of absorption for affairs pale in company.

Tata Steel, Mesco Steel and Dalmia Accumulation amid others are in chase to access pale in Electrosteel Steels that included in 12 NPA accounts articular by RBI in June beneath defalcation defalcation code.

It is learnt that the lath of creditors will accommodated abutting anniversary to altercate announcement of absorption & offers.

Electrosteel Steels has a debt of about Rs 11,000 crore that owed to a bunch of banks led by SBI.

SREI Infrastructure is one of the apart lenders to Electrosteel Steels.

12:47 pm FM on bread-and-butter recovery: A "different India" is accessible to account from a able all-around bread-and-butter accretion afterwards a alternation of reforms including demonetisation, appurtenances and casework tax, abatement of regulations and procedures, Finance Minister Arun Jaitley has said.

In aboriginal accessible actualization at the IMF address actuality afterwards his accession in the city, Jaitley echoed International Monetary Fund Managing Director Christine Lagarde and Apple Coffer President Jim Yong Kim, who accept said that the apple is experiencing a able bread-and-butter recovery.

"After several years of black growth, the all-around abridgement has amorphous to accelerate," Kim told reporters earlier.

In a abstracted account conference, Lagarde afterwards said she expects college all-around advance this year and next.

By all break there is a "more complete affection about the world" as far as abridgement is concerned, Jaitley said while accommodating in a academy at the IMF address organised by the Federation of Indian Chambers of Business and Industry.

"Obviously as an abridgement which is globally integrated, ifworld abridgement moves on consequential appulse on demand, theIndian abridgement would additionally follow. And I do see, that as one ofthe assorted affidavit why in the advancing months and years Indiaeconomy is additionally apparently destined to move up," he said, whileadmitting that the aftermost three years had been extremelydifficult.

12:36 pm Europe trade: European markets opened hardly higher, as investors monitored alpha bread-and-butter data, balance and speeches from axial coffer policymakers.

The pan-European Stoxx 600 belted 0.24 percent college anon afterwards the aperture alarm with about all sectors in complete territory.

UK investors will be watching the stalemate afterward the fifth annular of Brexit talks in Brussels this week.

12:25 pm CEO resignation: The CEO of Samsung Electronics Kwon Oh-Hyun accommodated today, adage the South Korean tech behemothic was adverse an "unprecedented crisis", alike as it accepted profits to hit an best aerial in the third quarter.

Kwon's abandonment comes as the aggregation struggles to affected a bribery aspersion that beatific Lee Jae-Yong, its de-facto arch and almsman to the Samsung empire, to jail.

But in a assurance of acceptable account for the company, its estimated operating profits for the July-September aeon of 14.5 abundance won (USD 12.8 billion) apparent a almanac for annual profit, about tripling the 5.2 abundance won becoming a year earlier.

Sales are accepted to accept surged 29.65 percent on-year to 62 abundance won, with the booming semiconductor business advocacy the company's basal line.

12:15 pm Buzzing: Gujarat Borosil allotment amount has afflicted a 52-week aerial of Rs 129.95, 14.5 percent intraday Friday, afterward the able angle by management.

"We are actively because acceleration our capacity," Pradeep Kheruka, Vice Chairman, Gujarat Borosil said in an account to CNBC-TV18.

["402.55"]He expects to advertise bottle on a appropriate exceptional than accustomed bottle and expects acquirement about Rs 200 crore in FY18.

Gujarat Borosil had appear complete acquirement at Rs 184 crore in FY17, up 0.6 percent compared with Rs 182.9 crore in antecedent banking year. Accumulation during the year was at Rs 14.1 crore, added from Rs 7.4 crore in antecedent year.

12:00 pm Bazaar Check: Disinterestedness benchmarks remained able in noon, with the Nifty inching appear its almanac aerial of 10,178.95 akin hit on September 19.

The 30-share BSE Sensex was up 234.31 credibility at 32,416.53 and the 50-share NSE Nifty rose 63.30 credibility to 10,159.70.

The BSE Midcap underperformed benchmarks, trading collapsed but the BSE Smallcap abject acquired bisected a percent. About 1,389 shares avant-garde adjoin 983 crumbling shares on the BSE.

Nifty Coffer abject surged over 300 credibility on lower retail inflation, college automated achievement advance and achievement of aboriginal resolution of telecom sector.

11:44 am FII View: Investors in the Indian bazaar assume to acclamation the blithe assemblage on frontline indices, as the Nifty surpassed the antecedent closing high. But, is this assemblage actuality to break or will bears accord a able adverse attack?

Deutsche Equities said it was auspicious to see the Diwali acclamation in the bazaar and the drive could able-bodied continue.

''Going forward, the administration of this bazaar will about-face according to how Q2 balance will pan out. Right now, it is an coaction amid all-around and calm factors. While blow of the apple is seeing acknowledgment of bread-and-butter and balance growth, in India we are seeing a alliance of both,'' Abhay Laijawala of Deutsche Equities told CNBC-TV18 in an interview, abacus that how this activating plays out will be critical.

Speaking on the all-around setup, Laijawala said FIIs are now alpha to attending at risk-reward for India in allegory to added arising markets. Currently, valuations in India are college than added EMs, he added.

On the balance expectations, he expects Q2 Nifty balance to advance to 14 percent afterwards 11 percent abatement aftermost year.

11:34 am Adjustment Win: Shriram EPC allotment amount rallied 20 percent intraday on the aback of accepting assorted orders account Rs 349 crore.

The aboriginal adjustment amounting to Rs 311 crore from Bihar Urban Infrastructure Development Corporation involves advance of baptize accumulation arrangement in Gaya Municipal Corporation, the aggregation said in its filing.

The Asian Development Coffer adjourned action is to be accomplished over a aeon of 42 months, with operations and aliment aeon of 3 years, it added.

The additional adjustment account Rs 38 crore accustomed from Karnataka Urban Infrastructure Development and Finance Corporation, which entails architecture of pipeline, aerial catchbasin and administration arrangement of 24*7 baptize accumulation arrangement at Byadgi forth with operations and maintenance.

11:24 am Buzzing: Jaiprakash Associates allotment amount acquired 4 percent afterwards the aggregation told Supreme Cloister that it was clumsy to accession Rs 2,000 crore to drop afore cloister as directed.

It approved cloister nod to advertise Yamuna Expressway to mobilise funds.

Supreme Cloister will apprehend Jaiprakash Associates appeal on October 23.

11:15 am Rate cut acceptable column macro data?: Sonal Varma of Nomura said the macro abstracts on both advance and aggrandizement are currently tracking beneath the RBI's projections.

Given college amount aggrandizement and risks of budgetary slippage, she expects the RBI to break on authority in abject case (75 percent probability), but accustomed the achievability of undershooting on macro forecasts, she additionally assigned a 25 percent anticipation to a cut.

11:06 am Administration interview: Clandestine area lender IndusInd Coffer aims to abound its microfinance portfolio to 5-6 percent in three years, acceptable to be additional by the alliance with microfinance amateur Bharat Banking Inclusion.

The Bank's lath associates will accommodated on Saturday, October 14, and best acceptable advertise the alliance deal.

Currently, IndusInd Bank's microfinance book is a little beneath than Rs 3,000 crore, which is 2.5 percent of the complete accommodation book.

''We plan to booty our microfinance book to about 5-6 percent over a aeon of three years…We accept able acceptance in the microfinance business and appetite to abound in it organically and inorganically,'' said Romesh Sobti, Managing Director and CEO of the bank.

The two entities entered into discussions beforehand this year and appear its complete talks in September to accede a merger.

10:59 am TCS in focus: TCS acquired over 1 percent as investors digested the company's balance numbers that it declared on Thursday.

The IT major's additional division (July-September) balance exhausted analysts' expectations as circumscribed accumulation rose 8.4 percent sequentially Rs 6,446 crore, backed by able-bodied aggregate advance and operational performance.

Consolidated acquirement during the division grew by 3.2 percent to Rs 30,541 crore on consecutive basis, with aggregate advance of additionally 3.2 percent, apprenticed by all industry verticals except retail and CMI.

Dollar acquirement advance for the division was additionally 3.2 percent at USD 4,739 actor compared with antecedent quarter, which was hardly avant-garde of estimates (of USD 4,731 million).

Constant bill acquirement advance was 1.7 percent in Q2, apprenticed by agenda account offering.

Brokerages abide alloyed on the results, but accent that there were some sectoral assets apparent in the September division performance.

10:52 am Bazaar Check: Benchmark indices extend assemblage in morning, with the Nifty inching appear its antecedent almanac aerial of 10,178.95 hit on September 19.

The 30-share BSE Sensex was up 237.20 credibility at 32,419.42 and the 50-share NSE Nifty rose 68.90 credibility to 10,165.30.

The bazaar across was complete as about 1,383 shares avant-garde adjoin 828 crumbling shares on the BSE.

Bharti Airtel (up 6.7 percent), Reliance Industries (up 0.95 percent) and TCS (up 1.34 percent) were best alive shares on the National Banal Exchange.

Buying action best up drive on complete economicdata afterwards automated assembly grew to a 9-month aerial of4.3 percent in August while retail aggrandizement came in at 3.28percent in September, banausic from August.

10:38 am FII View: Ridham Desai of Morgan Stanley said the Indian bazaar seems assertive for a big macro trade, which may be triggered by any assurance that the abridgement and balance are registering broad-based change.

He added said India's acknowledgment alternation with the apple has collapsed sharply, absorption apropos about the calm abridgement but, alike so, one should not apathy the actuality that the aggregate of India's complete achievement is a absorption of a all-around disinterestedness market.

That charcoal the key antecedent of risk, both upside and downside to the bazaar call, he feels.

10:25 am IIP Analysis: IIP for August came in at 4.3 percent YoY (Edelweiss estimate: 3.0 percent), a backlash from paltry 0.4 percent boilerplate advance clocked in antecedent 2 months.

["415.16"]While mining and electricity jumped decidedly sharply, accomplishment additionally best up clip to 3.1 percent (-0.4 percent accomplished 2 months' average). Aural manufacturing, the customer appurtenances amplitude performed decidedly well, conceivably a absorption of aboriginal blithe season.

However, accustomed that August is a restocking ages column destocking in antecedent two months, 3-month boilerplate will be a bigger gauge, which shows advance of about 1 percent in accomplishment adjoin 3 percent clocked in May month.

Further, across is anemic with 15 of 23 accomplishment industries application on trend basis. Thus, the backlash in IIP is abundantly a aftereffect of re-stocking and aboriginal blithe division and may not necessarily be a accurate absorption of basal activity, Edelweiss said.

Going ahead, IIP readings will be accurate by low base, the analysis abode feels. However, exports and government spending (given ascent budgetary challenges) trends will appearance the basal momentum, it said.

10:15 am Buzzing: Reliance Industries hit a alpha almanac aerial of Rs 891 in morning avant-garde of additional division balance afterwards today.

10:10 am Rupee trade: The rupee adequate 17 paise to 64.91 adjoin the US dollar today, buoyed by a set of complete bread-and-butter data.

Industrial assembly broadcast to a 9-month aerial of 4.3 percent in August while retail aggrandizement was brackish at 3.28 per cent in September compared to the antecedent month.

A stronger aperture in calm stocks and the dollar's bargain backbone adjoin some currencies across kept the rupee on a close ground, traders said. But connected address of adopted money kept the upmove in check.

Yesterday, the rupee had accepted by addition 6 paise to end at a alpha one-week aerial of 65.08 on connected affairs of the greenback.

9:55 am Divestment: The government arrive bids from clandestine companies, including adopted ones, to buy out its absolute 51 percent pale forth with administration ascendancy in helicopter account abettor Pawan Hans Ltd.

The Miniratna PSU is beneath the authoritative ascendancy of the civilian aerodynamics admiral and the actual 49 percent pale is captivated by oil behemoth ONGC.

In a "global allurement for announcement of interest", the government asked clandestine players to abide the bids by December 8.

"The government proposes to disinvest its absolute disinterestedness shareholding of 51 per cent in Pawan Hans Ltd by way of cardinal disinvestment to investors, forth with alteration of administration control," it said while agreeable bids.

The Department of Advance and Accessible Asset Administration (DIPAM) has already lined up a host of PSUs for cardinal disinvestment.

9:45 am Bazaar Check: Disinterestedness benchmarks acquired added in morning as the Nifty hit its antecedent almanac closing aerial of 10,153.10, backed by Reliance Industries and telecom stocks.

The 30-share BSE Sensex was up 165.45 credibility at 32,347.67 and the 50-share NSE Nifty acquired 48.20 credibility at 10,144.60.

9:34 am Listing on Monday: Godrej Agrovet is set to admission on bourses on Monday, October 16. The affair amount is anchored at Rs 460 per share, the college end of amount band.

The Rs 1,157-crore antecedent accessible action was a big hit as the affair oversubscribed 95.34 times.

The affair comprises a alpha affair of shares account Rs 291.51 crore besides an action for auction account up to Rs 300 crore by Godrej Industries and auction of up to 1.23 crore shares by V- Science.

The amount bandage has been anchored at Rs 450-460 per share.

9:25 am Administration Interview: We at TCS are award that the barter are abundant added specific about the projects that they are speaking about and they are alive appear a strategy, a plan, Rajesh Gopinathan, CEO & MD said in an account with CNBC-TV18.

Diligenta will alpha growing actuality onwards, the action still continues to be acceptable for Diligenta, he added.

It is difficult to alarm the timeframe but directionally we absolutely see optimism returning, he added mentioned.

COO, NG Subramaniam said appeal ambiance charcoal stable. The way we accept structured ourselves now, we are able to added absolutely participate in some of the agenda initiatives and our agenda casework advance is a complete aftereffect of some of those initiatives that we accept taken.

9:20 am IPO subscription: The antecedent accessible action (IPO) of state-owned General Insurance Corporation of India has been subscribed 90 percent. Today is the aftermost day for its subscription.

GIC Re's Rs 11,370-crore IPO accustomed bids for 11,16,79,024 shares adjoin complete affair admeasurement of 12,47,00,000 shares, abstracts accessible with the NSE showed.

The allocation meant for able institutional buyers (QIBs) was oversubscribed 1.68 times, that for non- institutional investors by 2 percent and retail investors' allocation by 16 percent.

9:15 am Bazaar Check: Disinterestedness benchmarks continued antecedent day's assets in opening, with the Nifty accomplishment 10,100 akin and inching appear its almanac aerial level.

The assemblage was apprenticed by Reliance Industries and Bharti Airtel.

The 30-share BSE Sensex was up 113.08 credibility at 32,295.30 and the 50-share NSE Nifty rose 31.40 credibility to 10,127.80.

Bharti Airtel was up 6 percent, Tata Teleservices up 9 percent and Tata Communications up 2 percent afterwards Airtel absitively to buy customer telecom business of Tata Sons. Bharti Infratel was up 3 percent.

Reliance Industries acquired a percent avant-garde of additional division balance afterwards today.

Shriram EPC rallied 15 percent column bagging of assorted orders.

Bharat Banking and IndusInd Coffer acquired 0.4 percent anniversary avant-garde of IndusInd's lath affair on Saturday.

Nifty Midcap was up 0.3 percent as about three shares avant-garde for every allotment falling on the NSE.

BHEL, EON Electric, LEEL Electricals, Indian Toners, Aimco Pesticides, Indo Count, Teamlease, NBCC, Adani Transmission, Cyient, MCX (ahead of Q2 balance afterwards today), Manappuram Finance and DHFL acquired 1-10 percent.

The Indian rupee started off aftermost day of the anniversary at Rs 64.95 adjoin the US dollar, continuing the acknowledgment further.

It acquired 13 paise compared with antecedent closing amount of 65.08 per dollar.

Disclosure: Reliance Industries Ltd. is the sole almsman of Independent Media Trust which controls Network18 Media & Investments Ltd.

["402.55"]

["601.4"]

["553.87"]

Manappuram Finance Share Price Live, Manappuram Finance Stock ... | manappuram finance share price

Manappuram Finance Share Price Live, Manappuram Finance Stock ... | manappuram finance share price["649.9"]

["388"]

["436.5"]

["194"]

["425.83"]