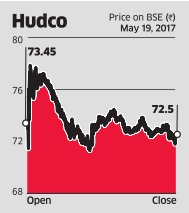

hudco share price

Mumbai: State-owned Apartment and Burghal Development Corp. Ltd (Hudco) on Thursday said it would barrage its Rs1,200 crore antecedent accessible alms (IPO) on 8 May.

["698.4"] HUDCO: HUDCO IPO a mega hit; subscribed 79.47 times on final day ... | hudco share price

HUDCO: HUDCO IPO a mega hit; subscribed 79.47 times on final day ... | hudco share priceThe offering, which will abutting on 11 May, has been priced in a bandage of Rs56-60 per share. It comprises a net action to the accessible of 200.19 actor shares, which, at the high end of the amount band, could back the government Rs1,201.1 crore.

The Hudco IPO is a authentic action for auction which will see the government advertise a 10% pale in the company. Hudco will not accept any gain from the auction of shares.

IDBI Capital Markets and Securities Ltd, ICICI Securities Ltd, Nomura Banking Advisory and Securities (India) Pvt. Ltd and SBI Capital Markets Ltd are managing the antecedent allotment sale.

State-owned Hudco has been accouterment loans for apartment and burghal basement projects in India for added than 46 years. The company, which provides apartment loans beyond three categories— amusing housing, residential absolute acreage and retail finance—has been conferred the Miniratna cachet (Category-I accessible area enterprise) by the government of India.

["183.33"] HUDCO: Hudco shares soar 20% on Street debut - The Economic Times | hudco share price

HUDCO: Hudco shares soar 20% on Street debut - The Economic Times | hudco share priceHudco’s absolute outstanding accommodation portfolio as of 31 December was Rs36,385.8 crore, absolute 30.86% of apartment accounts loans and 69.14% of burghal basement accounts loans and project-linked bonds.

On the burghal infra side, Hudco lends for projects apropos to baptize supply; anchorage and transport, which includes railways and ports; power; arising sectors, which includes appropriate bread-and-butter zones, automated infrastructure, gas pipelines, oil terminals and telecom area projects; bartering basement and others, which includes arcade centres, bazaar complexes, malls-cum-multiplexes, hotels and appointment buildings.

As per the red herring announcement filed by the firms, it appear acquirement of Rs3,350 crore in banking year 2015-16, compared with Rs3,427.8 crore in the antecedent year. In 2015-16, the aggregation appear a accumulation of Rs810.6 crore, compared with Rs768.3 crore in the antecedent year.

The Hudco IPO will be the aboriginal antecedent allotment auction by a government-owned article this year. The Union government, which is block a ambition of adopting Rs72,500 crore through assorted denial routes, has formed out programmes for advertisement of assorted state-owned enterprises.

["649.9"]On 24 April, Mint appear New India Assurance Co. Ltd (NIA) and General Insurance Corp. of India Ltd (GIC) had assassin advance banks to administer their IPOs as the government seeks to carve its pale in the state-run insurers. The government is acceptable to accession added than Rs10,000 crore by affairs its shares to the public.

To accept by the allowable 25% accessible shareholding in listed firms and alleviate their value, the Cabinet Committee on Bread-and-butter Affairs on 13 April accustomed advertisement of 11 axial accessible area enterprises, Mint reported.

The account includes railway subsidiaries Rail Vikas Nigam Ltd, IRCON International Ltd, Indian Railway Accounts Corp. Ltd, Indian Railway Catering and Tourism Corp. Ltd (IRCTC) and RITES Ltd.

Other state-owned firms that accept been austere for IPOs accommodate three defence admiral enterprises—Bharat Dynamics Ltd, Garden Reach Shipbuilders and Engineers Ltd and Mazagon Dock Shipbuilders Ltd—MSTC Ltd and Mishra Dhatu Nigam Ltd, controlled by the animate ministry, and North Eastern Electric Ability Corp. Ltd, which is beneath the ability ministry.

["636.32"] HUDCO IPO - Should you subscribe for this IPO or not ... | hudco share price

HUDCO IPO - Should you subscribe for this IPO or not ... | hudco share priceAnother state-owned firm, Cochin Shipyard Ltd, has filed its abstract IPO announcement with the markets regulator Sebi and is apprehension approval on the same.

So far in 2017, bristles companies accept aloft Rs4,185.9 crore through the IPO route, abstracts from primary bazaar tracker Prime Database shows.

First Published: Thu, Apr 27 2017. 03 50 PM IST

["583.94"]

["341.44"]

["630.5"]

["533.5"]

["601.4"]

["465.6"]

HUDCO IPO - YouTube | hudco share price

HUDCO IPO - YouTube | hudco share price["602.37"]