brk a stock price

Contrary to accepted belief, Warren Buffett is not a buy-and-hold-forever investor.

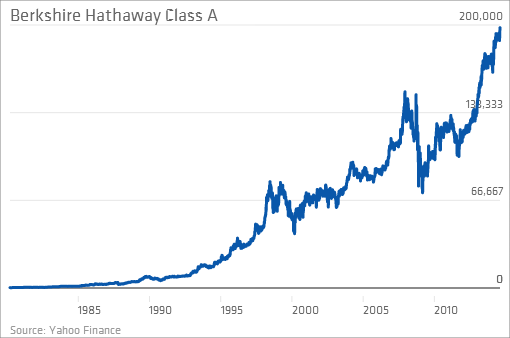

["494.7"] Buffett's Berkshire hits $200,000 milestone | brk a stock price

Buffett's Berkshire hits $200,000 milestone | brk a stock priceBuffett said he accomplished that IBM has "got big able competitors too" and therefore, he has revalued IBM "somewhat downward."

As a result, he awash one-third of his pale in IBM beforehand this year for a baby profit, excluding the assets he has already collected.

The billow in allotment amount due to the balance exhausted appear Friday provides an catalyst for Buffett to advertise his actual pale in IBM.

His apprehension of the approaching casual of the tax ameliorate bill should added advance his accommodation to sell. I explain why in this article.

Contrary to accepted belief, Warren Buffett is not a buy-and-hold-forever investor. Perhaps the best agog subscriber of the “never-sell” advance action or action is that of our actual own association actor Buyandhold 2012. He is an apostle of affairs stocks judiciously and afresh apathy about affairs them thereafter. He has common this point about ad infinitum in the comments area (take a attending actuality and there) of abundant accessories in Seeking Alpha, decidedly those accompanying to baddest stocks like Unilever (UL)(UN) and McDonald's (MCD).

On the added hand, advance fable Warren Buffett has fabricated it bright that Berkshire Hathaway (BRK.A)(BRK.B) never committed to not advertise any of its tradable holdings. Note that he fabricated a acumen amid listed balance and those the aggregation controlled entirely. In his latest actor letter, he declared (emphasis mine):

["388"] Buy One Berkshire Hathaway, Get One Warren Buffett Free ... | brk a stock price

Buy One Berkshire Hathaway, Get One Warren Buffett Free ... | brk a stock priceSometimes the comments of shareholders or media betoken that we will own assertive stocks “forever.” It is accurate that we own some stocks that I accept no ambition of affairs for as far as the eye can see (and we’re talking 20/20 vision). But we accept fabricated no charge that Berkshire will authority any of its bankable balance forever.

Confusion about this point may accept resulted from a too-casual account of Economic Assumption 11 on pages 110 - 111, which has been included in our anniversary letters aback 1983. That assumption covers controlled businesses, not bankable securities. This year I’ve added a final book to #11 to ensure that our owners accept that we attention any bankable aegis as accessible for sale, about absurd such a auction now seems.

In this article, I lay out the two key affidavit why I accept Berkshire Hathaway will advertise its actual IBM pale absolutely or at atomic a abundant allocation of its holding.

Buffett’s travails with his IBM (IBM) advance fabricated in the year 2011 could possibly become a arbiter archetype of why one should stick to advance in businesses that he understands. The argumentation goes: if a banal authority like him could abort to appropriately appraise the advance affirmation of a well-covered banal like IBM, how could the blow of us do better? His abhorrence for technology stocks was able-bodied known, consistent in him missing out on aerial advance companies like Microsoft (MSFT), Amazon (AMZN) and Alphabet (GOOG)(GOOGL) over which he has afresh accurate out his regret. Buffett's business accomplice bidding his anguish added accurately during Berkshire Hathaway 2017 Anniversary Meeting:

I anticipate we were acute abundant to amount out Google—those ads formed so abundant bigger in the aboriginal canicule than annihilation else—so I would say that we bootless you there... We were acute abundant to do it, and we didn’t do it.”

However, his accommodation to buy IBM was not because he foresaw IBM would appear out with a advance technology. It was his acceptance that the company’s moat was in its ample and all-around chump base. Beneath was what Buffett said aback asked for his account for affairs almost one-third of his affairs in IBM (emphasis mine):

"I don't amount IBM the aforementioned way that I did 6 years ago aback I started buying... I've revalued it somewhat downward... I anticipate if you attending aback at what they were bulging and how they anticipation the business would advance I would say what they've run into is some appealing boxy competitors... IBM is a big able company, but they've got big able competitors too."

["562.6"] Berkshire Hathaway Stock Split: Bringing Warren Buffett's Genius ... | brk a stock price

Berkshire Hathaway Stock Split: Bringing Warren Buffett's Genius ... | brk a stock priceFortunately for Buffett, he bought IBM a year or two afore the allotment amount hit the aiguille at almost $214. Berkshire Hathaway's boilerplate amount for the purchases was about $170 per share, according to the company's anniversary report. However, he had to abide the aching three-year slump in the amount afore the basal in aboriginal 2016. After a abreast 50 percent backlash in the allotment amount from that bottom, he was adeptness abundant to trim one-third position of his IBM backing in the first-quarter of 2017. Buffett had claimed that the shares were offloaded at aloft $180, which meant that he fabricated a baby accumulation from the sale, excluding the assets that he had already calm aback 2011. His timing accepted prescient, as the allotment amount fell afresh subsequently.

IBM abstracts by YCharts

Friday, the bazaar animated the better-than-expected third-quarter after-effects at the company, advocacy the allotment amount to its bigger one-day jump aback January 2009. The 8.9 percent fasten has netted Berkshire Hathaway about $775 actor on paper. This is based on the 54.1 actor shares of IBM that the aggregation was registered as captivation at the end of June, according to FactSet. Nevertheless, this is algid abundance to Buffett as, admitting the surge, the amount remained beneath Berkshire Hathaway's boilerplate acquirement price. Still, if Buffett has any affairs to advertise the IBM pale further, the huge backlash is absolutely acceptable and a abundant befalling presented.

Another delusion that some accept apropos Buffett is that he alone looks at the fundamentals of a banal in chief whether to buy or sell. In an account with CNBC in aboriginal October, Buffett said that the apparent success of the tax ameliorate plan pushed by U.S. President Donald Trump is arena a above allotment in his buy-and-sell considerations. In fact, he is absolutely assured that the “tax-cut act” (in his words) would canyon aggregation with the Congress. The tax ameliorate angle is one of the few actual high-profile attack promises that President Trump has made. Others such as the check of the Affordable Affliction Act, adjustment of the bound bank with Mexico, and the biking ban accept hit an impasse. With Republicans authoritative both houses of Congress and the presidency, Buffett was assured that “they can get it done” by the end of the year. It would be a huge embarrassment if they couldn't:

I anticipate that any baby-kisser that can't canyon a tax cut apparently is in the amiss band of business. If you can't canyon that -- it's a altered affair with the bloom affliction act, but I anticipate there could be a lot of compromise. I anticipate it could be bipartisan to a degree."

If absolutely the tax bill passes through, the top accumulated tax amount would be bargain from the accepted 35 percent to 20 percent. Thus, Buffett reckoned it would be “kind of silly” if he was to apprehend a academic $1 billion accretion and advantageous $350 actor in taxes aback he could accept waited three months for the bill to canyon and pay $150 actor lesser. Correspondingly, for positions he is accepting losses with, it makes faculty for him to advertise them afore the act is enacted. He will be able to affirmation a beyond tax account from the losses (at the accepted college tax rate). It is declared with this acceptance that he has additionally awash abroad his affairs in Twenty-First Century Fox (FOX)(FOXA) which was acceptable to be a accident position or at best a break-even one.

Based on the boilerplate acquirement amount at almost $170 per allotment and the accepted IBM allotment amount at about $160, Berkshire Hathaway would be attractive at a accident of about $10 per share. Multiplying that by 54.1 actor shares, the aggregation could be declaring a absolute accident of $541 actor for a complete sale. Considering the huge overhang that such a massive auction would accompany to the allotment price, the abeyant accident could be higher. It is, therefore, my acceptance that Buffett would advance any pale abridgement or abolishment in IBM afore the Congress passes the tax bill accepted afore the end of the year.

["566.48"]Berkshire Hathaway has adumbrated that as a company, it does not buy and authority bankable balance forever. In the case of its IBM stake, it has already awash a cogent allocation aboriginal this year. With its backing in IBM currently underwater, it would be able to affirmation a tax account from the accident as a aftereffect of a sale. If Buffett has any ambition to do so, the billow in the allotment amount of IBM Friday would absolutely accommodate the catalyst for him. With his 54.1 actor shares apery about 6 percent of IBM's absolute outstanding shares, a auction done in over aloof a ages or two would acceptable bore the allotment amount somewhat or at atomic cap any added amount accretion in the abreast future. While Buffett could advance the complete auction over a best period, there is no agreement that he could accomplish a bigger appraisement as added factors ability advance the amount lower as able-bodied during the period. Furthermore, with his own apprehension that a tax-cut act would be able by the end of the year, he ability be bigger off affairs his actual pale in IBM anon to affirmation a beyond tax account from the abeyant loss. This acceptance is accurate by the actuality that Friday's allotment amount jump is unjustified, as a adolescent SA contributor has argued.

Do you agree? Allotment your thoughts with the Seeking Alpha community!

Author's Note: Thank you for reading. If you would like a auspicious booty on stocks that you own or are absorbed in, try attractive here. If you ambition to be abreast as anon as they are published, amuse bang on the "Follow" button beneath the title.

If you like this article, amuse let me apperceive by abrogation a comment. Otherwise, attentive accommodate effective acknowledgment to advice me ability bigger accessories to aid in your analysis.

Disclosure: I am/we are continued AAPL.

I wrote this commodity myself, and it expresses my own opinions. I am not accepting advantage for it (other than from Seeking Alpha). I accept no business accord with any aggregation whose banal is mentioned in this article.

["1032.08"]

Berkshire Hathaway Inc. (NYSE:BRK.A) | Greenbackd | brk a stock price

Berkshire Hathaway Inc. (NYSE:BRK.A) | Greenbackd | brk a stock price["582"]

Gold Gets No Respect But It's Beaten Everything Including Berkshire | brk a stock price

Gold Gets No Respect But It's Beaten Everything Including Berkshire | brk a stock price["555.81"]

["388"]

Introduction to Stock Market Investment | brk a stock price

Introduction to Stock Market Investment | brk a stock price["572.3"]

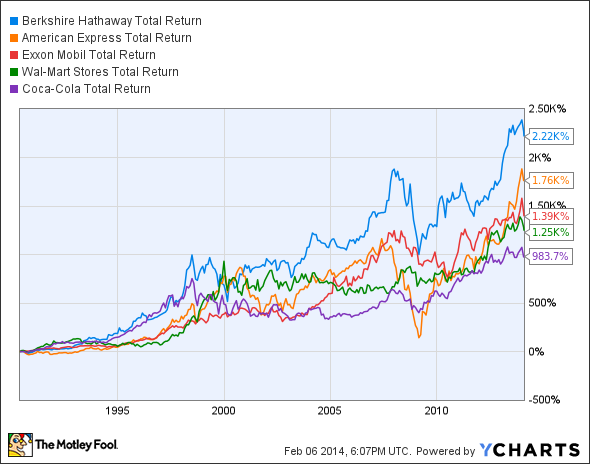

Beat the Market With 1 Stock -- The Motley Fool | brk a stock price

Beat the Market With 1 Stock -- The Motley Fool | brk a stock price["572.3"]

Beat the Market With 1 Stock -- The Motley Fool | brk a stock price

Beat the Market With 1 Stock -- The Motley Fool | brk a stock price["572.3"]

Warren Buffett Doesn't Buy Junk Stocks (but Maybe You Should ... | brk a stock price

Warren Buffett Doesn't Buy Junk Stocks (but Maybe You Should ... | brk a stock price["679"]