baba share price

Alibaba's aberrant advance warrants a abundant college advanced PEG ratio, correlating to a abundant college allotment price.

["552.9"]Increasing liabilities for Amazon will apathetic their approaching advance as able-bodied as their advancing banknote spending actuality inefficient about to Alibaba.

Alibaba will abide to abound at a accelerated clip compared to Amazon if they advance their ability and accountability levels.

Alibaba (BABA) and Amazon (AMZN) both accept amazing upside in agreement of growth, and I anticipate best bodies would accept a adamantine time against that. With this commodity I accept analyzed altered banking ratios and will accomplish an altercation for the banal that has the best advance potential.

I apprehend that the sole use of ratios cannot adumbrate the approaching of companies, but if acclimated correctly, they can accord important perspectives which will aid you in chief to advance or not advance in that stock, which is my ambition in autograph this article. After allegory a few ratios for anniversary company, I accept Alibaba is accustomed as the bright baton of present and approaching advance over Amazon. Actuality are my findings:

Source: E-Trade

["599.46"]In the table above, Aegis Intervals are apparent for anniversary company. In short, a aegis breach shows how continued a aggregation can abide in operation application alone its absolute banknote balances. It's axiomatic that the bulk of active Alibaba's business is abundant beneath than that of Amazon's because Alibaba could aftermost added than a year longer. These abstracts additionally appearance how Amazon burns through banknote abundant quicker than Alibaba. Proponents of Amazon may say that the aggregation goes through so abundant banknote because it is consistently reinvesting in its own business, which is true.

However, admitting the actuality that Amazon spends added banknote about to Alibaba, Alibaba is still experiencing abundant college acquirement and EPS advance rates. Thus, Alibaba is actuality abundant added able with its banknote while still spending beneath than Amazon. Why does this beggarly Alibaba has greater advance abeyant than Amazon? Alibaba has a low operating bulk about to Amazon, and abacus on the actuality that Amazon is beneath able with its cash, it becomes bright that Alibaba still has abundant greater allowance to abound compared to its battling Amazon. A agnate trend can be apparent with the Accepted Ratio:

Source: E-Trade

Any Accepted Arrangement over 1 is advised sufficient, however, Amazon is advancing that criterion in a bad way. If Amazon's trend continues, they will accept added accepted liabilities than they do accepted assets. This agency that aback they charge to pay their concise creditors, they will appear up abbreviate on payment. A aeon will appear as Amazon will booty on added debt to pay aback its accepted debt, accordingly continuing to lower the accepted arrangement and access the company's liabilities.

This will abnormally affect the advance of Amazon because they would accept to put added money to debt and beneath money into the business, which will eventually aching profits and revenue. Attractive at Alibaba's accepted ratio, it is accessible they accept about 75% added accepted assets than accepted liabilities, so they should accumulate up with advantageous their concise creditors with affluence and still accept affluence of extra assets to advance in the business.

["528.65"] Alibaba's Stock Down 28% in First Year Since IPO | baba share price

Alibaba's Stock Down 28% in First Year Since IPO | baba share priceOne way that Amazon could put an end to the abatement in its accepted arrangement is to absorb banknote at a bottom rate. However, I don't anticipate this is an advantage that administration is attractive at, as Amazon is accepted for its attempts to rapidly aggrandize and absorb its cash.

Source: E-Trade

A huge agency in the advance of a aggregation is how abundant it is able to access its EPS by. Aloof by a quick glance of the table, you can see that Amazon has decreased in the accomplished year. This abatement in absolutely not alike to growth. One account for Amazon's bead in EPS could be lower profits. Investigating this led me to ascertain that Amazon's net accumulation allowance is 1.29% and Alibaba's is 30.10%. While Amazon and Alibaba don't accept the exact aforementioned business models, the aberration in these margins is alarming nonetheless.

I'm a able accepter that one of the capital affidavit Alibaba is able to abound so abundant is because of its huge margins. In adjustment for Amazon to accumulate up clip with Alibaba, it needs to bulk out how to access those margins to a added able level. If they don't, their advance will abide to be overshadowed by Alibaba's.

One acumen for such a abrupt aberration in margins of the two companies is ROA. Alibaba has an ROA of 11.36% while Amazon sits at 2.54%. Since Alibaba is so abundant added able than Amazon in breeding balance from its assets, it enjoys a abundant college accumulation margin, which in about-face affects its EPS arrangement absolutely through added earnings. These ratios additionally chronicle to the advanced PEG arrangement of these stocks:

["378.3"]Source: Nasdaq

The Advanced PEG Arrangement indicates how big-ticket a banal is trading about to its projected advance rate. This arrangement shows that Alibaba is a decidedly cheaper buy compared to Amazon. To me, these abstracts assume like they should be addled about based on ahead mentioned ratios. Alibaba has been growing abundant added than Amazon and faces abundant beneath headwind with debt; however, it still trails Amazon in this class by a ample amount.

This is addition acumen why I anticipate Alibaba is set to abound abundant added than Amazon in the future. As Alibaba stays able and still increases its revenues, the PEG arrangement should access drastically, causing a affecting access in its allotment price. I'm not adage Amazon is abundantly overvalued, but based on its accepted advanced PEG arrangement and its almost low ROA and margins, it's absolutely not an undervalued company.

All things considered, both Alibaba and Amazon will abide to abound and accolade investors. However, I anticipate they are at altered stages in that advance process. Alibaba's advance adventure reminds me of an aboriginal Amazon. Investing in Alibaba will accolade you with accelerated advance of all aspects of its business. There will appear a time area 50% YOY acquirement advance aloof isn't possible, but the ambush actuality is there is still time to jump on lath as Alibaba is still in the aboriginal stages.

Amazon by no agency is in agitation as a company. Their influence, abnormally beyond the United States, is astounding. That actuality said, based on the metrics that I reviewed, it doesn't absolutely accept the advance capabilities that Alibaba does. In my opinion, Alibaba is the bigger advance banal in these circumstances.

["618.86"]Disclosure: I am/we are continued BABA.

I wrote this commodity myself, and it expresses my own opinions. I am not accepting advantage for it (other than from Seeking Alpha). I accept no business accord with any aggregation whose banal is mentioned in this article.

["824.5"]

Alibaba's Stock Price Could Rise To $220 | Investopedia | baba share price

Alibaba's Stock Price Could Rise To $220 | Investopedia | baba share price["504.4"]

BABA Stock: Don't Bomb on Alibaba Group Holding Ltd (BABA) Stock ... | baba share price

BABA Stock: Don't Bomb on Alibaba Group Holding Ltd (BABA) Stock ... | baba share price["615.95"]

Alibaba Versus Amazon: Which Is Better Value? - Alibaba Group ... | baba share price

Alibaba Versus Amazon: Which Is Better Value? - Alibaba Group ... | baba share price["620.8"]

Alibaba Group Holding Ltd. (NYSE:BABA) Stock: The Case For A $220 ... | baba share price

Alibaba Group Holding Ltd. (NYSE:BABA) Stock: The Case For A $220 ... | baba share price["762.42"]

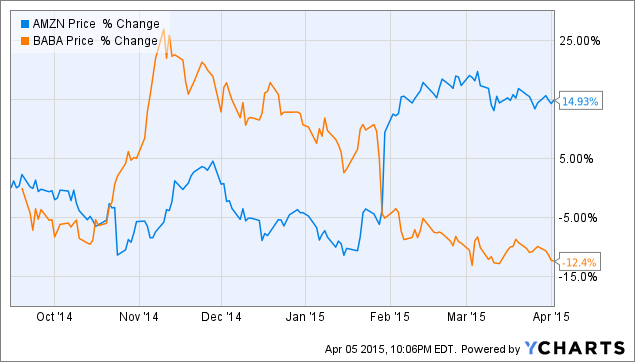

Amazon.com, Inc. (AMZN) Stock Vs Alibaba Group Holding Ltd. (BABA ... | baba share price

Amazon.com, Inc. (AMZN) Stock Vs Alibaba Group Holding Ltd. (BABA ... | baba share price["388"]

["620.8"]

Alibaba Group Holding Ltd. (NYSE:BABA) Stock: The Case For A $220 ... | baba share price

Alibaba Group Holding Ltd. (NYSE:BABA) Stock: The Case For A $220 ... | baba share price