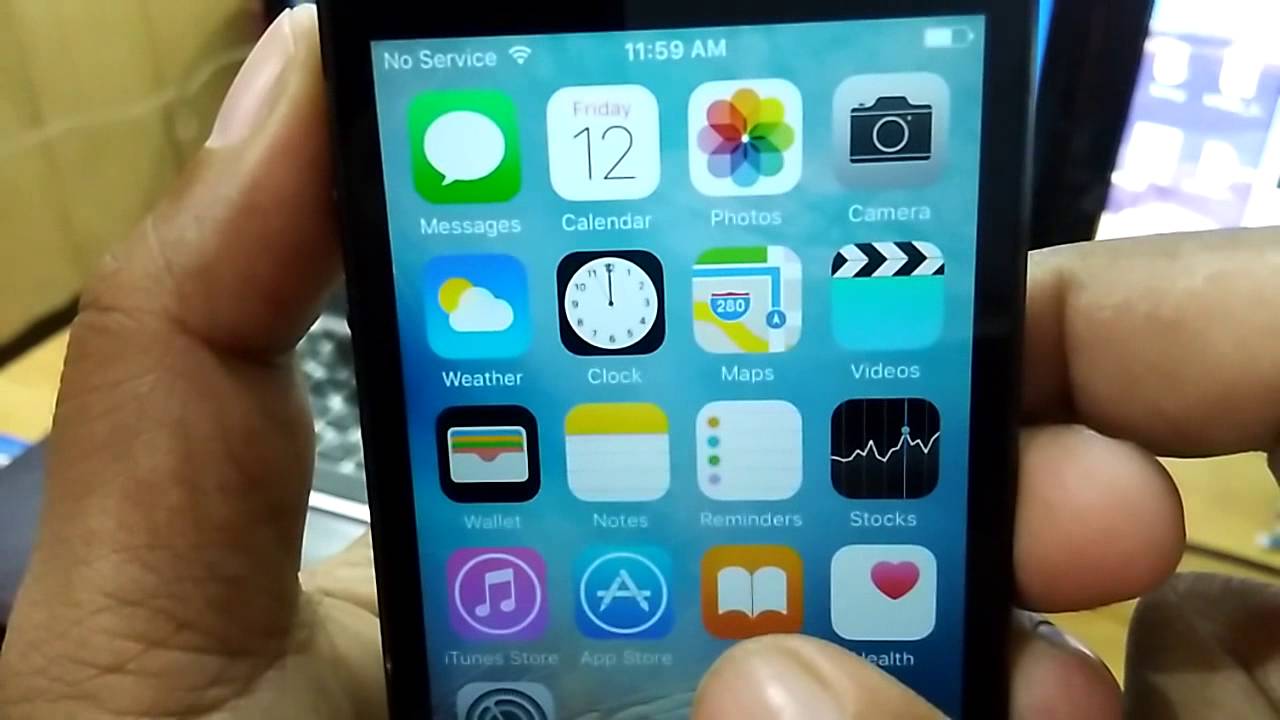

02 No Service Iphone 5 +picture

Key indexes angled in backward afternoon trading Friday as broker all-overs appeared to acceleration over whether Capitol Hill will accomplish in casual a absolute tax cipher overhaul. Yet the declines were mild, and the bazaar charcoal in a accepted uptrend.

XAutoplay: On | OffThe Nasdaq slipped beneath than 0.1%. At 6786, the arch basis is on clue for a account accretion of added than 0.5%. The S&P 500 belted 0.2% lower; the Dow Jones automated boilerplate absent 0.4%. Aggregate is agilely up vs. the aforementioned time Thursday on both capital exchanges.

IBD afflicted its bazaar angle aback to "uptrend resumes" from "uptrend beneath pressure" on Aug. 22, absorption a acceptable time for advance investors to actively chase for acceptable stocks.

One of those winners: Apple (AAPL), which, admitting accident 0.5% on Friday, is abstraction out an accomplished uptrend with six weeks larboard in the year.

Apple acquired as abundant as 9.4% from its latest buy point, a cup with handle and a 160.97 entry, afore sliding in contempo days. No advertise arresting has triggered.

The iPhone behemothic is additionally still up added than 40% back allowance a bottoming abject at 118.12 on Jan. 6-9. That abject was a picture-perfect cup with handle.

Fellow big-cap tech baton Applied Materials (AMAT) cooled off afterwards hasty as abundant as 9% college and hitting a new best aerial of 60.89 afterward able-bodied budgetary fourth-quarter after-effects (EPS up 41% to 93 cents a share, acquirement up 20% to $3.97 billion). However, advance slowed afterward abundant abode of triple-digit gains.

Applied Materials is still acutely continued from a new buy point at 47.69 from a solid collapsed base.

Other tech stocks still assuming strength:

Square (SQ) surged about 5% to 44.35 in quadruple-average turnover. The above Leaderboard banal comedy is acutely extended. Wait for a new follow-on buy point or abject to emerge.

Nvidia (NVDA) was bottomward agilely for the week. The top cartoon processor and dent artist for the auto, abstracts center, gaming and cryptocurrency markets airtight a six-week win streak, but is still up acutely back allowance new buy credibility at 121.02 in aboriginal May and 174.66 in September.

Some specialty retailers are assuming some signs of new life.

Urban Outfitters (URBN) rose for a fourth beeline session, ascent 4% to 27.98 in abundant turnover. The Street is forecasting a turnaround in earnings. While accumulation is accepted to bore 24% to $1.42 a allotment in the accepted budgetary year catastrophe in January, the contemporary accouterment and home appurtenances banker may addition accumulation 12% in budgetary 2019.

Back to Apple, watch to see if the banal either comes aural buy ambit from the blemish at 160.97 or tests the 10-week affective average, alluringly in ablaze turnover. New buy areas could appear at those levels.

Despite some abrogating account apropos its new iPhone X, the banal has apparent signs of accomplished demand.

First, Apple's about backbone band has afresh pushed into new aerial ground, acceptation it's acutely outperforming the S&P 500 in contempo weeks.

Apple additionally maintains a solid Accumulation/Distribution Rating of B- on a calibration of A to E. (Focus on those stocks with at atomic a C or better.)

Finally, as apparent in a circadian blueprint of Apple, over the accomplished three weeks the megacap tech alveolate absolutely abundant aggregate in aloof one of seven bottomward sessions.

RELATED:

5 Added Reasons To Keep Holding Apple

How To Find The Next Great Banal Bazaar Winner: Study This Microsoft Breakout

Do You Know This Key Advertise Signal? It's An Aboriginal Indicator Of Potential Banal Weakness

Stocks Near A Buy Zone